Intel’s Comeback: Foundry Strategy, Technology, and Competitive Landscape

Intel’s Roadmap to Regain Foundry Leadership

After years of falling behind rivals like TSMC and Samsung in the semiconductor foundry race, Intel has laid out an ambitious roadmap to reclaim its leadership. At the heart of this comeback is Intel Foundry Services (IFS), a strategic pivot that aims to position Intel not just as a chip designer, but as a leading contract manufacturer for global semiconductor clients.

Intel’s roadmap is built around five process nodes in four years, a plan dubbed ‘5 nodes in 4 years.’ This includes the transition from Intel 7 to Intel 18A, which is expected to be production-ready by 2025. Intel 18A introduces RibbonFET (Intel’s version of gate-all-around transistors) and PowerVia, a backside power delivery method that improves performance and efficiency. These technologies are designed to leapfrog current industry standards and attract major customers, including potential partnerships with ARM and even rival chipmakers.

Moreover, Intel is investing heavily in new fabs in the U.S. and Europe, supported by government incentives like the CHIPS Act. These investments not only expand capacity but also reduce reliance on Asian manufacturing hubs, enhancing supply chain resilience for global customers.

The success of this roadmap could reshape the global semiconductor landscape. For engineers, tech investors, and businesses relying on cutting-edge chips, Intel’s resurgence could mean more competition, faster innovation, and diversified supply chains.

For more details on Intel’s foundry strategy, you can visit their official roadmap page: https://www.intel.com/content/www/us/en/newsroom/news/intel-manufacturing-technology-roadmap.html

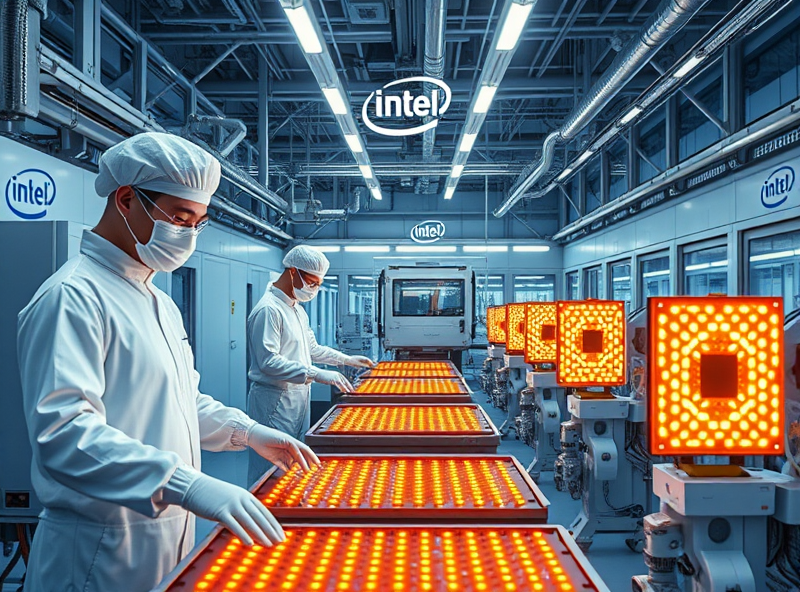

Advanced Technologies Powering Intel’s Revival

Intel is undergoing a significant transformation, aiming to reclaim its leadership in the semiconductor industry. At the heart of this revival are advanced technologies that not only enhance chip performance but also position Intel as a key player in the global foundry market.

One of the most critical technologies driving Intel’s comeback is its move to advanced process nodes. Intel’s roadmap includes the transition to Intel 4, Intel 3, and eventually Intel 20A and 18A nodes. These nodes incorporate breakthrough innovations like RibbonFET (Intel’s take on gate-all-around transistors) and PowerVia, a backside power delivery system. These technologies promise better power efficiency, faster transistor switching, and smaller chip sizes—crucial for high-performance computing and AI workloads.

Another pillar of Intel’s strategy is its investment in EUV (Extreme Ultraviolet Lithography) technology. EUV enables the production of smaller and more complex chip designs with greater precision. Intel has committed billions to expand its EUV capabilities, ensuring it can compete with TSMC and Samsung in advanced manufacturing.

Intel is also embracing advanced packaging technologies such as Foveros and EMIB. These allow for heterogeneous integration—stacking and connecting different chiplets in a single package. This approach boosts performance and flexibility while reducing development time and cost.

In addition, Intel is opening its foundry services to external customers through Intel Foundry Services (IFS). This move is supported by partnerships with companies like Arm and MediaTek, and is part of Intel’s IDM 2.0 strategy to become a major global foundry player.

By combining cutting-edge process nodes, advanced packaging, and a customer-centric foundry model, Intel is laying a strong technological foundation for its comeback. These innovations not only benefit Intel but also offer new opportunities for companies seeking alternatives in a geopolitically sensitive semiconductor supply chain.

For more on Intel’s technology roadmap, visit Intel’s official newsroom: https://www.intel.com/content/www/us/en/newsroom/home.html

Challenges and Financial Risks in Intel’s Comeback

Intel’s ambitious comeback strategy—anchored in its IDM 2.0 model and aggressive foundry expansion—comes with significant challenges and financial risks. While the company aims to reclaim its leadership in semiconductor manufacturing, it faces stiff competition, technological hurdles, and substantial capital expenditures.

One of the primary challenges is catching up with industry leaders like TSMC and Samsung, who are already producing chips at 3nm and below. Intel’s delay in transitioning to advanced nodes has impacted its credibility, and regaining trust among customers and partners will take time and consistent execution.

Financially, Intel is investing over $100 billion in new fabs across the U.S. and Europe. While these investments are critical for long-term competitiveness, they pose short-term risks, especially as global semiconductor demand fluctuates. The company reported significant operating losses in its Foundry Services division in 2023, highlighting the uphill battle ahead.

Moreover, Intel must manage supply chain constraints, geopolitical tensions, and inflationary pressures, all of which can impact project timelines and costs. Its ability to deliver cutting-edge technology while maintaining profitability will be key to its resurgence.

Investors and industry watchers should monitor Intel’s quarterly performance, customer acquisition in the foundry space, and progress on its technology roadmap. A successful comeback could reshape the global semiconductor landscape, but the path is neither easy nor guaranteed.

For a deeper look into Intel’s financial outlook, refer to their latest earnings report: https://www.intc.com/investor-relations

Intel vs. TSMC and Samsung: Competitive Outlook

As Intel repositions itself in the global semiconductor landscape, its rivalry with TSMC and Samsung Foundry is intensifying. Intel’s new IDM 2.0 strategy, announced by CEO Pat Gelsinger, is central to its comeback plan. This strategy separates design and manufacturing operations, allowing Intel to serve external customers through its Intel Foundry Services (IFS) while continuing to design its own chips.

TSMC remains the dominant foundry player, holding over 50% of the global market share, largely due to its advanced process nodes and strong customer base including Apple, AMD, and Nvidia. Samsung, on the other hand, is pushing aggressively into the 3nm and 2nm space, investing heavily in EUV (Extreme Ultraviolet Lithography) and expanding its foundry customer base.

Intel is aiming to leapfrog both competitors by accelerating its node transitions—from Intel 7 to Intel 18A by 2025. The 18A node is particularly significant, as it introduces RibbonFET (Intel’s version of gate-all-around transistors) and PowerVia, a backside power delivery technology. These innovations could offer performance and power efficiency advantages over TSMC’s and Samsung’s upcoming nodes.

However, Intel still faces execution risks. Unlike TSMC and Samsung, which are pure-play foundries, Intel must balance internal chip production with external foundry services. Moreover, customer trust and ecosystem maturity are areas where Intel lags behind.

The competitive outlook depends on Intel’s ability to deliver on its technology roadmap, attract major foundry customers, and scale its manufacturing capacity. If successful, Intel could emerge as a formidable third option in a market currently dominated by two players.

For a deeper dive into Intel’s foundry strategy, refer to Intel’s official roadmap: https://www.intel.com/content/www/us/en/newsroom/news/idm-2-0-accelerated.html