Why ASML Stock Is So Expensive (And Possibly Worth Every Penny)

ASML’s Market Dominance in Semiconductor Equipment

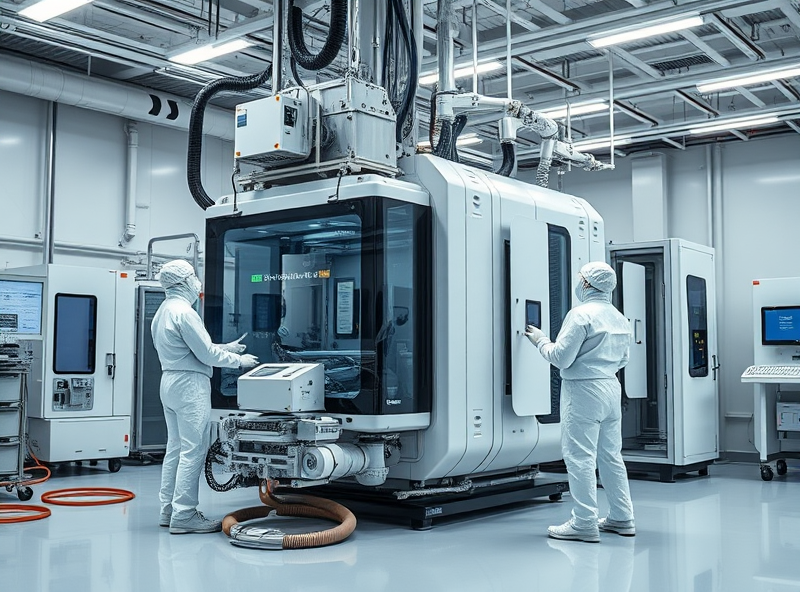

ASML is not just another tech company—it’s the backbone of the global semiconductor industry. At the heart of its high stock price lies a unique and powerful market position that few companies in the world can rival. ASML is the sole manufacturer of extreme ultraviolet (EUV) lithography machines, a critical technology used to produce the most advanced semiconductor chips. These machines are so complex and precise that only ASML has the expertise and infrastructure to build them, with each unit costing over $150 million.

This technological monopoly gives ASML a massive competitive edge. Its customers include all the major chipmakers—TSMC, Intel, and Samsung—who rely on ASML’s tools to produce cutting-edge chips used in everything from smartphones to AI data centers. As demand for faster, smaller, and more energy-efficient chips grows, so does the demand for ASML’s equipment.

Moreover, ASML’s dominance is protected by a deep moat of intellectual property, with over 14,000 patents, and long-term supply agreements that make it incredibly difficult for new competitors to enter the market. The company also benefits from geopolitical tailwinds, as countries and corporations race to secure chipmaking capabilities amid global supply chain tensions.

In short, ASML’s stock is expensive because it holds a near-monopoly on an indispensable technology in a rapidly growing industry. For long-term investors, this kind of market dominance can justify a premium price tag.

For more insights into ASML’s technology and its role in the semiconductor supply chain, you can visit: https://www.asml.com/en/technology

ASML’s Market Dominance in Semiconductor Equipment

ASML’s stock price may seem sky-high, but there’s a compelling reason behind it: the company holds a near-monopoly on the most advanced lithography machines used in semiconductor manufacturing. These machines, especially ASML’s EUV (Extreme Ultraviolet) lithography systems, are essential for producing the tiny, powerful chips that drive everything from smartphones to AI data centers.

Unlike traditional lithography, EUV uses light with extremely short wavelengths to etch incredibly fine patterns onto silicon wafers. This enables chipmakers like TSMC, Intel, and Samsung to pack billions of transistors into a single chip, dramatically improving performance and energy efficiency. The catch? Only ASML makes these EUV machines, and each one costs upwards of $150 million.

ASML’s technological edge is the result of decades of R&D, deep collaboration with partners like Zeiss (for optics), and a supply chain that spans the globe. This makes their machines not only irreplaceable but also incredibly difficult to replicate. In fact, building a single EUV system involves over 100,000 components and takes months to assemble.

For investors and tech enthusiasts alike, understanding ASML’s role is crucial. The company isn’t just selling machines—it’s enabling the future of computing. As demand for advanced chips continues to grow, ASML’s dominance in this niche but critical sector ensures its long-term value. That’s why many believe the stock is worth every penny.

For more on ASML’s technology, you can visit their official site: https://www.asml.com/en/technology

Financial Performance That Justifies a Premium Valuation

ASML’s stock price might seem lofty at first glance, but a closer look at its financial performance reveals why investors are willing to pay a premium. The company holds a near-monopoly in the production of extreme ultraviolet (EUV) lithography machines, which are essential for manufacturing cutting-edge semiconductors. These machines are not only highly complex but also incredibly expensive—each unit can cost over $150 million. Yet, demand remains strong, driven by global chipmakers like TSMC, Intel, and Samsung.

ASML’s revenue growth has been impressive. In 2023, the company reported over €27 billion in net sales, with a gross margin exceeding 50%. Its consistent profitability, robust free cash flow, and high return on invested capital (ROIC) make it a standout in the semiconductor industry. Moreover, ASML’s backlog of orders provides long-term revenue visibility, a rare advantage in such a cyclical sector.

What also sets ASML apart is its strategic importance in the global tech supply chain. As nations race to secure chip production capabilities, ASML’s tools become even more indispensable. This geopolitical relevance adds another layer of value, justifying its high valuation.

For a deeper dive into ASML’s financials, you can visit their official investor relations page: https://www.asml.com/en/investors

Navigating the Risks: Geopolitical Tensions and Market Cycles

ASML’s stock price often raises eyebrows due to its premium valuation, but when we examine the global context—especially geopolitical tensions and market cycles—it becomes clear why investors are willing to pay top dollar. ASML holds a near-monopoly on extreme ultraviolet (EUV) lithography machines, which are essential for producing the most advanced semiconductors. This makes ASML not just a company, but a strategic asset in the global tech race.

However, this strategic importance also exposes ASML to significant geopolitical risks. For instance, ongoing tensions between the U.S. and China have led to export restrictions on advanced chip-making equipment. ASML, being a Dutch company, has found itself at the center of this tug-of-war. The Dutch government, under pressure from allies, has restricted the export of some of ASML’s most advanced tools to China. This could limit ASML’s market access and revenue growth in one of the world’s largest semiconductor markets.

In addition, market cycles in the semiconductor industry are notoriously volatile. Periods of high demand are often followed by sharp downturns due to overcapacity or macroeconomic slowdowns. ASML’s long-term contracts and backlog help cushion some of this volatility, but they are not immune to cyclical risks.

Despite these challenges, ASML’s technological edge and irreplaceable role in the chip supply chain make it a resilient investment. Investors should stay informed about geopolitical developments and industry cycles, as these factors can influence both short-term volatility and long-term growth potential.

For a deeper understanding of how geopolitical factors affect global trade and technology, you can refer to the Council on Foreign Relations’ analysis here: https://www.cfr.org/backgrounder/us-china-tech-war