ACA Subsidies 2025: How Much Can You Save on Health Insurance?

Understanding ACA Premium Subsidies for Families

If you’re exploring health insurance options for your family in 2025, understanding how ACA (Affordable Care Act) premium subsidies work can make a big difference in your monthly budget. These subsidies are designed to make health insurance more affordable for low- to middle-income families by reducing the cost of monthly premiums.

The amount you can save depends on your household income and the number of people in your family. For 2025, subsidies are still calculated based on a sliding scale that compares your income to the federal poverty level (FPL). Families earning up to 400% of the FPL may qualify for premium tax credits, and under the American Rescue Plan and Inflation Reduction Act extensions, even some families earning above that threshold may still be eligible.

For example, a family of four earning around $80,000 annually could see thousands of dollars in savings per year on their health insurance premiums. These subsidies are applied directly to your monthly premium, so you pay less each month.

To estimate your savings, you can use the official HealthCare.gov calculator, which takes into account your income, family size, and location: https://www.healthcare.gov/lower-costs/

It’s important to update your income and household information each year during open enrollment to ensure you receive the correct subsidy amount. Overestimating or underestimating your income can affect your tax refund or result in repayment at tax time.

By understanding how these subsidies work, families can make informed decisions and potentially save thousands on essential health coverage.

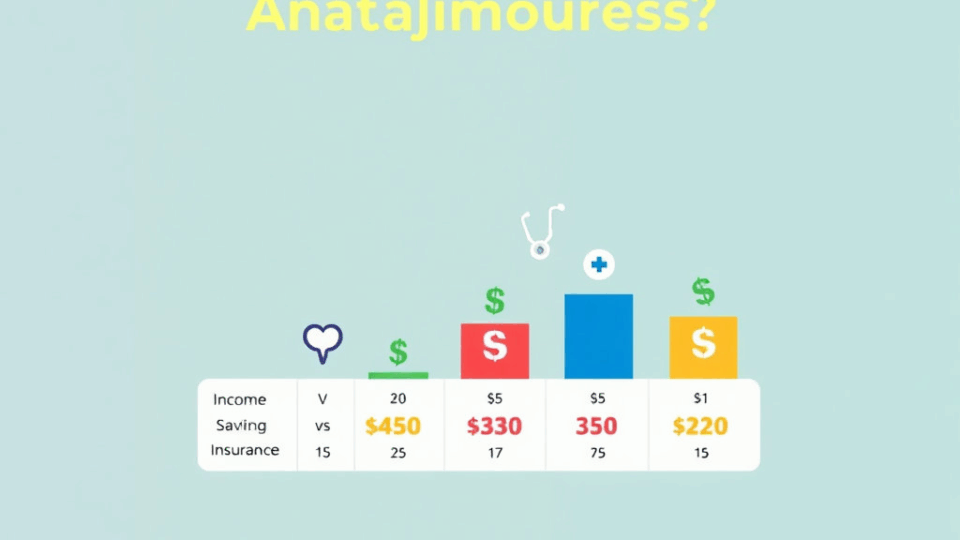

How Much Help Can You Get? Real-Life Savings Examples

Navigating health insurance costs can be overwhelming, but the Affordable Care Act (ACA) subsidies for 2025 are designed to make coverage more affordable for millions of Americans. These subsidies are based on your income and household size, and they can significantly reduce your monthly premiums—sometimes even down to $0.

Let’s take a look at some real-life examples to understand how much you could save:

1. A single adult earning $30,000 annually: In 2025, this person could qualify for a monthly premium as low as $40 for a Silver plan, thanks to premium tax credits. Without subsidies, the same plan might cost over $450 per month.

2. A family of four earning $60,000 annually: This household could receive over $1,000 per month in subsidies, reducing their premium to under $100 per month for a comprehensive Silver plan. Without assistance, they might pay over $1,400 monthly.

3. A couple in their early 60s earning $70,000: Age can increase premiums, but ACA subsidies adjust for this. This couple could still receive $800+ in monthly subsidies, keeping their premium under $300, compared to a full price of nearly $1,100.

These examples show how the ACA continues to make health insurance more accessible. The 2025 subsidy levels remain generous, especially with the extension of enhanced subsidies under the Inflation Reduction Act.

To estimate your own savings, you can use the official HealthCare.gov calculator: https://www.healthcare.gov/see-plans/

Remember, open enrollment for 2025 starts in November, so it’s a great time to review your options and take advantage of the help available.

What Happens in 2025? The End of ARPA Subsidies Explained

In 2025, a major shift is expected in the affordability of health insurance under the Affordable Care Act (ACA). The enhanced subsidies introduced by the American Rescue Plan Act (ARPA) in 2021 are set to expire at the end of 2024 unless Congress takes action to extend them. These temporary subsidies significantly lowered monthly premiums for millions of Americans by increasing the income eligibility cap and reducing the percentage of income required to be spent on premiums.

If these enhanced subsidies are not renewed, many individuals and families could see their health insurance costs rise sharply in 2025. For example, middle-income households who previously paid no more than 8.5% of their income for coverage may now face higher premiums or even lose eligibility for subsidies altogether. This change could especially impact those earning just above 400% of the federal poverty level (FPL), who were previously excluded from premium tax credits before ARPA.

To prepare, it’s important to:

– Review your current ACA plan and estimate how much your premiums could increase without the ARPA subsidies.

– Explore alternative coverage options, such as Medicaid (if eligible) or employer-sponsored insurance.

– Stay informed about legislative updates that may extend or replace the ARPA provisions.

For a detailed breakdown of how subsidies work and what changes to expect, visit the Kaiser Family Foundation’s subsidy calculator: https://www.kff.org/interactive/subsidy-calculator/

Understanding these changes now can help you make informed decisions during the 2025 Open Enrollment period and avoid unexpected financial strain.

Income Limits and Who Qualifies for ACA Help in 2024

If you’re planning to enroll in a health insurance plan through the Affordable Care Act (ACA) Marketplace in 2024, understanding income limits is key to determining whether you qualify for financial help. These subsidies, also known as premium tax credits, are designed to make health coverage more affordable for individuals and families with low to moderate incomes.

In 2024, eligibility for ACA subsidies is primarily based on your household income as a percentage of the Federal Poverty Level (FPL). Generally, if your income falls between 100% and 400% of the FPL, you may qualify for premium tax credits. Thanks to the Inflation Reduction Act, enhanced subsidies have been extended through 2025, meaning even some households earning above 400% of the FPL may still receive help, depending on the cost of coverage in their area.

Here’s a quick breakdown of 2024 income limits based on household size:

– 1 person: $14,580 to $58,320

– 2 people: $19,720 to $78,880

– 3 people: $24,860 to $99,440

– 4 people: $30,000 to $120,000

These numbers represent the 100% to 400% FPL range. If your income is below 138% of the FPL and you live in a state that expanded Medicaid, you may qualify for Medicaid instead of Marketplace subsidies.

It’s also important to note that eligibility is based on your estimated income for the coverage year—not your income from the previous year. So if your financial situation has changed, you may now qualify for help even if you didn’t before.

To check your eligibility and estimate your savings, you can use the official HealthCare.gov calculator: https://www.healthcare.gov/lower-costs/

Understanding these income thresholds can help you plan ahead and make informed decisions about your health coverage options. With the right information, you can potentially save thousands of dollars a year on premiums and out-of-pocket costs.