Types of Grant Fraud in the U.S. and How to Prevent Them

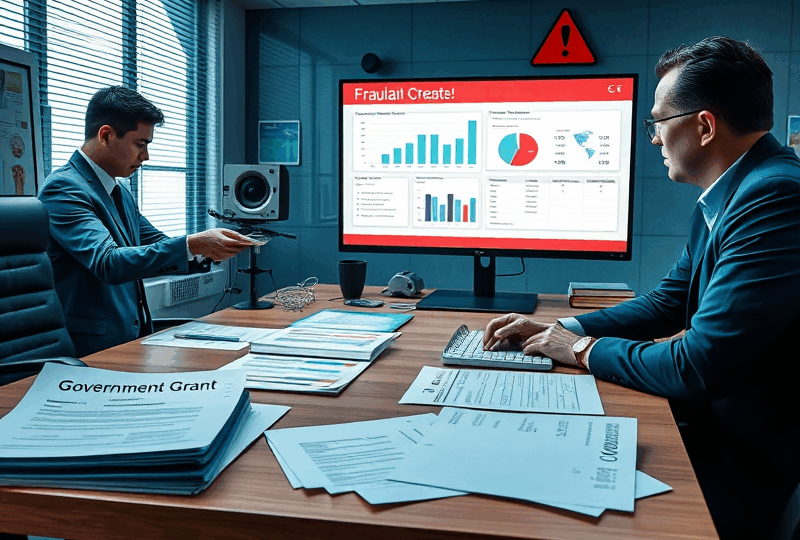

Falsified Documentation in Grant Applications

Falsifying documents in grant applications is one of the most common and serious types of grant fraud in the United States. It involves submitting altered, fabricated, or misleading information to obtain funding that the applicant may not be eligible for. This can include fake financial statements, forged letters of support, manipulated data, or false claims about project outcomes.

Why is this a big deal? Because grant programs—whether federal, state, or private—are designed to support individuals and organizations that genuinely need funding to make a positive impact. When someone submits false documentation, it not only diverts resources from deserving applicants but also undermines public trust in the grant system.

To prevent this type of fraud, grant-making agencies and organizations should implement strong verification processes. This includes:

– Cross-checking submitted documents with third-party sources

– Using data analytics to flag inconsistencies

– Requiring notarized statements or certifications

– Conducting random audits and site visits

For applicants, it’s important to understand that providing false information can lead to severe consequences, including repayment of funds, disqualification from future grants, and even criminal charges.

If you’re applying for a grant, always ensure your documentation is accurate, complete, and honest. Transparency not only protects you legally but also strengthens your credibility with funders.

For more detailed guidance on preventing grant fraud, you can visit the U.S. Department of Justice’s page on grant fraud: https://www.justice.gov/grants/grant-fraud

Fake Employee Listings and Payroll Manipulation

One of the more deceptive forms of grant fraud in the U.S. involves fake employee listings and payroll manipulation. This occurs when organizations receiving federal or state grants inflate their payroll records or list non-existent employees to divert funds for unauthorized use. In some cases, real employees are listed with exaggerated salaries, or former employees remain on payroll long after they’ve left.

This type of fraud not only misuses taxpayer money but also undermines the integrity of legitimate grant programs. For small nonprofits and research institutions, such fraud can lead to severe penalties, including loss of funding, legal action, and reputational damage.

To prevent this, organizations should implement strict internal controls. This includes regular payroll audits, cross-verification of employee records, and separation of duties between HR and finance departments. Additionally, using automated payroll systems with audit trails can help detect inconsistencies early.

Grant administrators and auditors should also be trained to recognize red flags such as unusually high payroll expenses, inconsistent employee data, or duplicate employee IDs. The U.S. Department of Justice and the Office of Inspector General (OIG) frequently investigate such cases, emphasizing the importance of compliance and transparency.

For more information on how the federal government monitors grant fraud, you can visit the U.S. Department of Justice’s official page: https://www.justice.gov/criminal-fraud/grant-fraud

How Fraudsters Exploit Co-Funding Requirements

In the U.S. grant system, co-funding requirements are often used to ensure that applicants have a vested interest in the success of a project. These requirements ask grant recipients to contribute a portion of the project’s cost, either through direct financial investment or in-kind contributions. While this mechanism is designed to promote accountability and shared responsibility, it can unfortunately be exploited by fraudsters.

One common tactic is inflating or fabricating co-funding sources. For example, an applicant might claim to have secured matching funds from a private investor or another grant, when in reality, those funds do not exist. This can be done through forged letters of commitment, fake bank statements, or misrepresented in-kind contributions. Once the grant is awarded, the promised co-funding never materializes, and the fraudster either diverts the funds or fails to deliver the project.

Another scheme involves circular funding. In this case, fraudsters use grant money from one source to fulfill the co-funding requirement of another grant, creating a deceptive cycle that misleads multiple agencies. This tactic can be hard to detect without cross-agency communication and data sharing.

To prevent these types of fraud, grant-making agencies should:

1. Rigorously verify co-funding sources through direct contact with third-party funders.

2. Require detailed documentation and financial statements with traceable records.

3. Conduct random audits and site visits to confirm that promised resources are actually being used.

4. Use data analytics and inter-agency databases to detect patterns of circular funding or repeated suspicious behavior.

For individuals and organizations applying for grants, it’s essential to be transparent and honest about your funding sources. Not only does this uphold the integrity of your project, but it also helps maintain trust in the grant system as a whole.

For more information on federal grant compliance and fraud prevention, you can visit the U.S. Government Accountability Office (GAO): https://www.gao.gov

Falsified Documentation in Grant Applications

One of the most common types of grant fraud in the U.S. involves submitting falsified documentation during the application process. This can include inflated budgets, fake letters of support, forged signatures, or misrepresented organizational qualifications. These deceptive practices not only undermine the integrity of the grant system but also divert critical funding away from legitimate projects and communities in need.

To prevent this type of fraud, grant-making agencies and organizations should implement thorough vetting procedures. This includes verifying the authenticity of documents, cross-checking references, and conducting background checks on applicants. Additionally, using digital tools like document verification software and requiring digital signatures can help detect tampering or inconsistencies early in the review process.

For grant applicants, it’s essential to maintain transparency and accuracy in all submitted materials. Misrepresentation, even if unintentional, can lead to disqualification, legal consequences, and reputational damage. Training staff on ethical grant writing and compliance standards can further reduce the risk of errors or fraudulent behavior.

For more information on grant fraud prevention, you can visit the U.S. Department of Justice’s official page on grant fraud: https://www.justice.gov/grants/grant-fraud