Unlock the Future: Your Guide to Growth Investing and Finding Tomorrow’s Star Companies!

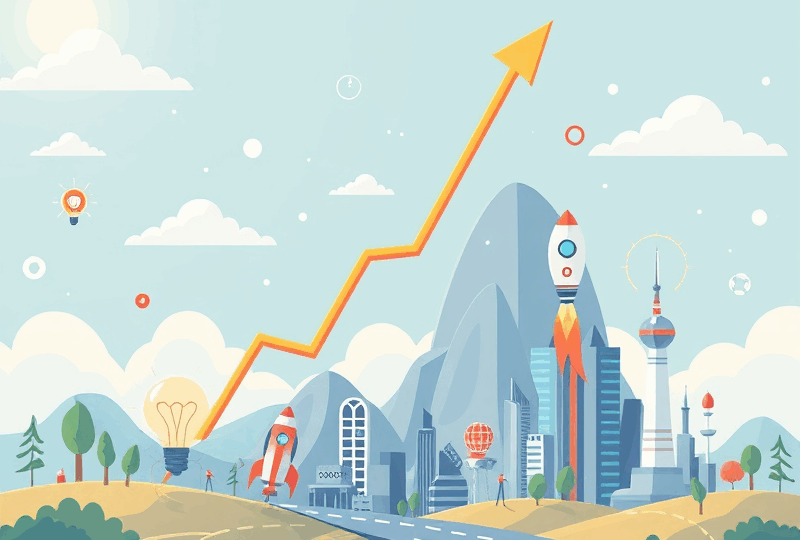

Are you excited by innovation? Do you love thinking about what the world will look like in 5, 10, or even 20 years? If you’re fascinated by companies that are pushing boundaries, creating new technologies, and expanding rapidly, then growth investing might be a strategy that truly resonates with you! While value investing focuses on finding undervalued companies today, growth investing is all about identifying companies that are expected to grow their earnings and revenue at a much faster rate than the average company. It’s about investing in the future, in companies that have the potential to become tomorrow’s industry leaders. If you’re ready to look beyond today’s headlines and seek out the companies poised for significant expansion, let’s explore the exciting world of growth investing together!

Think about some of the biggest, most successful companies today. Many of them started as small, innovative businesses with huge potential for growth. Investors who identified that potential early on and invested in those companies saw incredible returns as the businesses expanded and their stock prices soared. Growth investing aims to find those kinds of companies – businesses that are in their growth phase, reinvesting their profits back into the business to fuel further expansion, rather than paying them out as dividends.

What Defines a Growth Stock?

So, what exactly makes a stock a “growth stock”? It’s primarily characterized by the company’s focus on rapid expansion and its potential for significantly increasing its revenue and earnings in the future. Here are some common traits of growth companies:

- **High Revenue and Earnings Growth:** This is the most defining characteristic. Growth companies are expected to increase their sales and profits at a rate significantly higher than the overall economy or their industry peers.

- **Focus on Reinvestment:** Instead of paying out dividends, growth companies typically reinvest most, if not all, of their earnings back into the business to fund research and development, expand operations, acquire other companies, or enter new markets.

- **Often in Innovative Industries:** Many growth companies are found in dynamic sectors like technology, biotechnology, renewable energy, or e-commerce, where there is rapid change and high potential for new markets or products.

- **Higher Valuation Metrics:** Because investors are paying for future potential, growth stocks often trade at higher valuation ratios like the Price-to-Earnings (P/E) ratio compared to value stocks or the market average. Investors are willing to pay a premium for the expectation of strong future growth.

- **Competitive Advantage:** Growth companies often possess a strong competitive advantage, such as proprietary technology, a powerful brand, a network effect, or a unique business model that allows them to capture market share and sustain their growth.

How to Spot Potential Growth Companies

Finding promising growth companies requires looking beyond current performance and trying to assess future potential. It involves research and thinking critically about market trends and innovation. Here are some tips for identifying potential growth stocks:

- **Look for Companies in Growing Industries:** Identify sectors that are poised for significant expansion due to technological advancements, changing consumer behavior, or demographic shifts. For example, areas like artificial intelligence, cloud computing, electric vehicles, or personalized medicine might be considered high-growth sectors.

- **Analyze Growth Rates:** Examine a company’s historical revenue and earnings growth. Is it consistently high? Look at analyst projections for future growth. While projections aren’t guarantees, they indicate market expectations.

- **Understand the Business Model:** How does the company make money? Is its business model scalable, meaning it can grow rapidly without a proportional increase in costs? Does it have a clear path to profitability if it’s not already highly profitable?

- **Assess Competitive Advantage (The “Moat”):** What makes this company special? What prevents competitors from easily taking its market share? A strong brand, patents, unique technology, or a dominant market position can be key indicators of a durable competitive advantage that can fuel sustained growth.

- **Evaluate Management:** Does the company have a strong, visionary management team with a proven track record of execution? Leadership is crucial for navigating growth challenges and seizing opportunities.

- **Consider Market Opportunity:** How large is the potential market for the company’s products or services? Is it a niche market, or is there a massive global opportunity? A large addressable market provides ample room for future expansion.

Growth Investing vs. Value Investing: What’s the Difference?

While both growth and value investing aim to make money in the stock market, they approach it from different angles. As we discussed, value investing focuses on buying stocks that are currently undervalued based on their existing assets and earnings. It’s about finding a bargain today.

Growth investing, on the other hand, is less concerned with a stock’s current valuation relative to its present earnings or assets. Growth investors are willing to pay a higher price today for the *potential* of significant future earnings and expansion. They are betting on the company’s ability to innovate, capture market share, and grow its profits rapidly over time. It’s about paying a premium for future potential.

Neither approach is inherently better than the other; they are simply different strategies that can be successful. Some investors choose to focus on one style, while others combine elements of both in their portfolio.

The Risks of Growth Investing

While the potential rewards of growth investing can be very high, it’s crucial to understand that it also comes with higher risks compared to investing in more established, stable companies. Here are some key risks:

- **Higher Volatility:** Growth stocks often experience more significant price swings than value stocks. Because their valuation is based heavily on future expectations, any news that impacts those expectations (positive or negative) can cause dramatic movements in the stock price.

- **Valuation Risk:** Since growth stocks often trade at high P/E ratios, there’s a risk that investors have become overly optimistic about the company’s future. If the company fails to meet those high expectations, the stock price can fall sharply as the valuation adjusts.

- **Dependence on Future Performance:** The success of a growth investment relies heavily on the company’s ability to execute its growth plans and achieve the expected future earnings. If the growth slows down or fails to materialize, the investment may not perform as hoped.

- **Competition:** High-growth industries often attract a lot of competition. A company’s competitive advantage might erode over time as new players enter the market or existing competitors innovate.

- **Sensitivity to Economic Conditions:** While some growth companies can thrive even in challenging economic times, many are sensitive to economic downturns, which can impact consumer spending or business investment, slowing down their growth.

Because of these risks, growth investing is often considered more suitable for investors with a higher risk tolerance and a longer time horizon who can withstand potential short-term volatility.

Building a Growth-Oriented Portfolio

If you decide that growth investing aligns with your goals and risk tolerance, how can you build a portfolio? You can research and invest in individual growth stocks that you believe have strong potential. Alternatively, you can invest in growth-oriented mutual funds or ETFs, which provide instant diversification across many growth companies. There are funds that focus on large-cap growth, small-cap growth, or specific growth sectors like technology or biotechnology. Investing in a diversified growth fund is often a recommended approach for beginners interested in this style.

Remember to diversify your growth investments across different industries and potentially different sizes of growth companies to help manage risk.

Patience is Still Key (Even in Growth!)

While growth stocks can be exciting, growth investing is still a long-term strategy. It takes time for companies to execute their growth plans and for that growth to be reflected in the stock price. Avoid the temptation to constantly trade in and out of growth stocks based on short-term news. Identify companies with strong long-term potential and give them time to grow.

In Summary: Investing in Tomorrow’s Leaders

Growth investing is a strategy focused on identifying and investing in companies that are expected to grow their revenue and earnings at a rapid pace. These companies often reinvest profits for expansion, operate in innovative industries, and trade at higher valuations based on future potential. While it offers the potential for high returns, it also comes with higher risks, including volatility and dependence on future performance. Finding growth companies involves analyzing growth rates, business models, competitive advantages, and management. It’s a strategy best suited for investors with a higher risk tolerance and a long-term perspective, often implemented through individual stock picks or diversified growth funds.

Ready to Seek Out Growth?

If the idea of investing in companies that are shaping the future excites you, growth investing might be a great fit. It requires research, a forward-looking perspective, and a willingness to accept higher volatility for the potential of significant long-term gains. Start by exploring industries you believe will grow, researching companies within those sectors, and consider starting with diversified growth funds. Embrace the journey of finding tomorrow’s star companies!