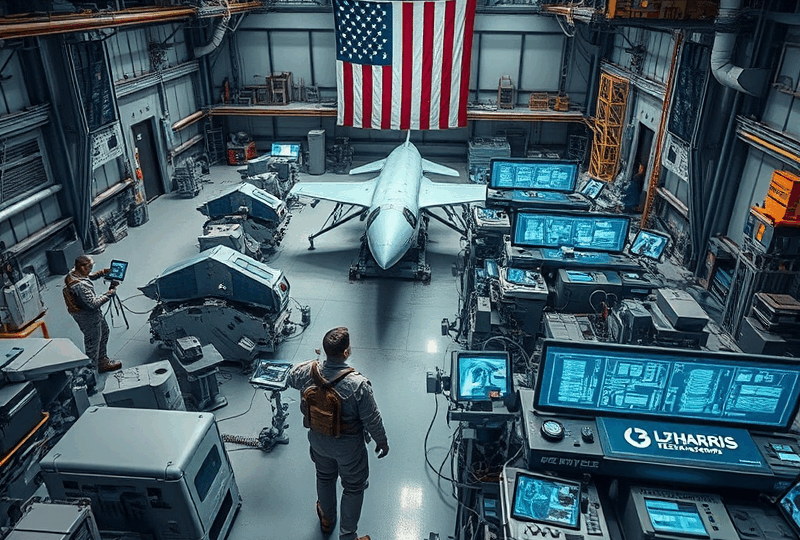

L3Harris Technologies Stock Analysis: Defense Growth Driven by U.S. Military Modernization and Strategic Innovation

Overview: L3Harris Technologies in the Modern Defense Landscape

L3Harris Technologies (NYSE: LHX) has emerged as a key player in the U.S. defense sector, especially as the Department of Defense (DoD) accelerates its modernization initiatives. While the company was formed in 2019 through the merger of L3 Technologies and Harris Corporation, its legacy in aerospace, communications, and surveillance systems spans decades. As of 2024, L3Harris is among the top 10 U.S. defense contractors by revenue, with a market capitalization hovering around $40 billion. The company’s focus on command and control systems, electronic warfare, and space-based assets aligns directly with the Pentagon’s strategic priorities.

Strategic Tailwinds: U.S. Military Modernization and Global Tensions

The U.S. defense budget for FY2025 reached $842 billion, reflecting a 3.2% increase from the previous year, with a significant portion allocated to advanced technologies and next-generation warfare capabilities. L3Harris is positioned to benefit from this trend, particularly through its involvement in the Joint All-Domain Command and Control (JADC2) initiative and space-based ISR (Intelligence, Surveillance, and Reconnaissance) programs. According to the U.S. Department of Defense, over $145 billion is earmarked for R&D, a record high, signaling a shift toward digital warfare and autonomous systems.

Case Study: L3Harris and the U.S. Space Force

In 2023, L3Harris secured a $700 million contract with the U.S. Space Force to develop and deploy missile warning satellites under the Next-Gen OPIR (Overhead Persistent Infrared) program. This project not only showcases the company’s capabilities in space defense but also highlights its growing relevance in the evolving geopolitical landscape, particularly with rising tensions in the Indo-Pacific region. The contract is expected to generate recurring revenue through 2030, reinforcing investor confidence in long-term growth.

Financial Performance and Peer Comparison

Below is a comparison of L3Harris with its key competitors as of Q1 2024:

| Company | Revenue (TTM) | Operating Margin | Dividend Yield | P/E Ratio |

|---|---|---|---|---|

| L3Harris | $18.2B | 11.5% | 2.2% | 17.8 |

| Raytheon Technologies | $72.5B | 9.8% | 2.4% | 21.3 |

| Northrop Grumman | $39.9B | 12.3% | 1.6% | 19.1 |

Source: Fidelity

Expert Insight: Analyst Perspective on LHX

According to defense analyst Byron Callan of Capital Alpha Partners, “L3Harris is uniquely positioned to capitalize on both near-peer competition and the Pentagon’s shift toward agile, software-defined systems. Their recent acquisitions in cyber and AI-enhanced ISR will likely prove accretive by 2025.” His view is echoed by Morgan Stanley, which recently upgraded LHX to “Overweight,” citing improved cash flow and margin expansion following cost optimization efforts in 2023.

Scenario Analysis: What Could Drive or Deter Future Growth?

Upside Scenario: If the U.S. increases defense spending by another 5% in FY2026, and L3Harris secures a larger share of JADC2 and space-based contracts, its EPS could grow by 12–15% annually through 2027.

Downside Scenario: Delays in government contract awards or budget cuts under a new administration could compress margins and slow revenue growth. Additionally, supply chain constraints in semiconductor components could impact delivery timelines.

Personal Perspective: Why I’m Watching LHX Closely

As a U.S.-based investor with a background in aerospace engineering, I find L3Harris particularly compelling due to its dual exposure to defense and space technologies. I first bought shares in early 2023, and since then, the stock has shown resilience despite broader market volatility. The company’s disciplined capital allocation, including a 2.2% dividend yield and $2 billion in share repurchases in 2023, signals strong shareholder alignment. For long-term investors seeking exposure to national security themes, LHX offers a balanced risk-reward profile.

Conclusion: A Strategic Bet on the Future of Defense

L3Harris Technologies stands at the intersection of innovation and national defense priorities. With the U.S. military undergoing a generational transformation, companies like LHX that offer agile, interoperable, and space-capable solutions are likely to thrive. While risks remain, particularly around political cycles and procurement delays, the company’s fundamentals and strategic positioning make it a noteworthy consideration for defense-focused portfolios.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. Please consult a licensed financial advisor before making any investment decisions. The author holds shares of L3Harris Technologies as of the date of publication.