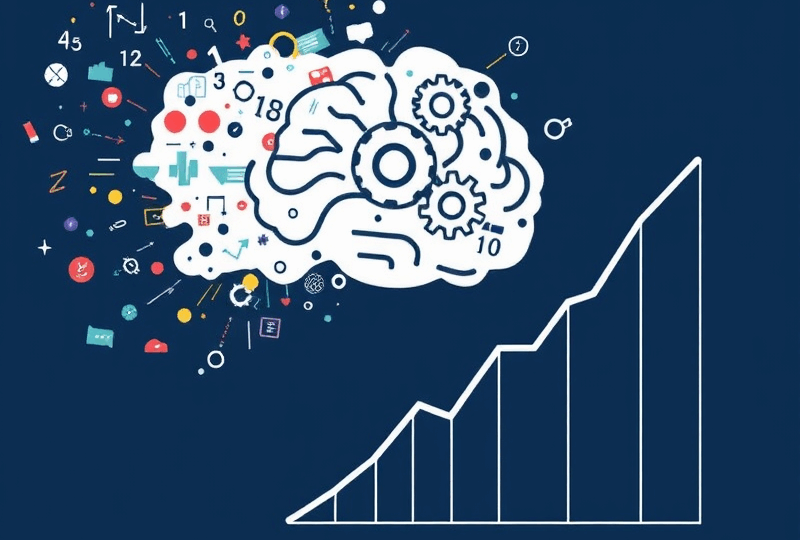

Beyond the Headlines: Why Reading and Thinking Are Your Most Powerful Investment Tools

Why are reading and thinking so crucial? Because investing is fundamentally about allocating your hard-earned capital to assets you believe will generate returns over time. Whether you’re buying a stock, a bond, or a piece of real estate, you are making a decision based on your understanding of that asset’s potential future value. This understanding doesn’t come from guesswork or emotion; it comes from informed analysis. And informed analysis begins with gathering information (reading) and processing it logically (thinking).

The Foundation: The Power of Reading

Reading in the context of investing isn’t just casual browsing. It’s a deliberate effort to absorb information that provides insight into the companies you might invest in, the industries they operate within, the broader economic environment, and the history of the markets themselves. What should you be reading? The list is extensive, but here are some key areas:

Company Financial Reports: This is fundamental, especially if you’re investing in individual stocks. Reading a company’s annual reports (10-K), quarterly reports (10-Q), and earnings releases provides a direct look at their financial health, revenue, expenses, debt, and cash flow. It tells you how the business is actually performing, not just what the stock price is doing. While these documents can be dense, focusing on key sections and metrics is invaluable.

Industry Analysis: Understanding the industry a company belongs to is crucial. Is it growing or shrinking? What are the competitive dynamics? What are the major trends and challenges? Reading industry reports, market research, and news specific to that sector helps you understand the environment in which your potential investment operates.

Financial News and Commentary: Staying updated on major economic news, interest rate changes, government policies, and global events is important because these factors can impact the market and specific companies. However, the key is to read critically, distinguishing between factual reporting and opinion, and understanding how the news *might* affect the long-term prospects of your investments, rather than just reacting to short-term headlines.

Investment Books and Educational Resources: Learning from experienced investors and financial educators through books, reputable blogs, and educational websites provides a solid foundation in investment principles, strategies, and market history. This kind of reading builds your overall financial literacy and helps you develop a sound investment philosophy.

Market History: Reading about past market cycles, bubbles, crashes, and economic events provides invaluable perspective. It teaches you that volatility is normal, that markets recover, and that human behavior (fear and greed) often repeats. Understanding history helps you avoid repeating past mistakes and maintain a long-term view.

Reading provides the raw material – the facts, figures, trends, and historical context – that you need to make informed decisions. It’s the input phase of the investment process.

The Engine: The Discipline of Thinking

Reading alone isn’t enough. You can read every financial report and news article, but without critical thinking, that information is just noise. Thinking is the process that transforms raw data into actionable insights. What does thinking involve in investing?

Analysis: This means breaking down what you’ve read. If you read a company’s earnings report, what do the numbers *really* mean? Is revenue growth sustainable? Is debt manageable? If you read a news article about a new technology, how might that technology impact the companies you own or are considering?

Synthesis: This is about connecting different pieces of information. How does the company’s performance relate to broader industry trends? How might a change in interest rates affect this specific business? How does a geopolitical event in one part of the world impact a global company’s supply chain or market demand?

Independent Judgment: This is perhaps the most crucial part. Thinking means forming your *own* conclusions based on your analysis, rather than simply accepting what analysts say or following the crowd. Why do *you* believe this company is a good investment? What are the potential risks that others might be overlooking? Successful investors often think differently from the consensus.

Long-Term Perspective: Thinking involves projecting into the future, not just reacting to the present. How will this company or industry look in 5, 10, or 20 years? What are the long-term trends that will shape its future? This kind of thinking helps you look beyond short-term fluctuations.

Evaluating Risk: Thinking critically means constantly assessing the potential downsides. What could go wrong? What are the major risks to this investment? How might different scenarios play out? This isn’t about being pessimistic, but about being realistic and prepared.

Thinking is the processing phase. It’s where you digest the information you’ve read, analyze it, connect it to other knowledge, form your own opinions, and evaluate the potential outcomes. It’s the engine that turns reading into investment wisdom.

Reading and Thinking: An Inseparable Duo

Reading and thinking are not separate activities in successful investing; they are two sides of the same coin, constantly feeding into each other. Reading provides the fuel for thinking, and thinking helps you understand what to read and how to interpret it. The more you read and think, the better you become at both.

For US stock investors, this means regularly reading SEC filings, earnings call transcripts, and reputable US financial news sources. It means thinking critically about the competitive landscape of US industries, the impact of US monetary and fiscal policy, and the specific strengths and weaknesses of US-listed companies. It’s about applying these intellectual tools to the specific context of the US market.

Avoiding Pitfalls Through Intellectual Discipline

Cultivating the habits of reading and thinking is your best defense against many common investment mistakes. They help you:

- Avoid Emotional Decisions: By grounding your decisions in analysis rather than fear or greed.

- Resist Hype and Fads: By understanding the fundamentals of a business rather than just following popular trends.

- Prevent Market Timing Mistakes: By focusing on the long-term value and prospects of an investment rather than trying to predict short-term price movements.

- Invest in What You Understand: By doing the necessary research and analysis before committing capital.

- Stay Disciplined: By having a well-thought-out rationale for your investments that helps you stick to your plan during volatile times.

In a world filled with instant information and constant distractions, the discipline to sit down, read carefully, and think deeply is a significant competitive advantage for any investor.

Making it a Habit

Like any skill, the ability to read and think critically about investments improves with practice. Make reading about investing a regular part of your routine, even if it’s just for 15-30 minutes a day. Dedicate time specifically for analyzing what you’ve read and thinking through the implications for your portfolio. Don’t be afraid to question assumptions, including your own. Discuss ideas with other thoughtful investors (but form your own conclusions). Over time, this consistent effort will sharpen your analytical skills and deepen your understanding of the markets.

Remember, the goal isn’t to become a walking encyclopedia of financial facts, but to develop the ability to process information effectively and make sound, independent judgments. This intellectual work is the true engine of long-term investment success.

Summary: The Enduring Power of the Mind

In summary, while market dynamics and financial instruments can seem complex, the core of successful long-term investing lies in the fundamental habits of reading and thinking. Reading provides the essential information about companies, industries, and markets, while thinking allows you to analyze that information, connect the dots, form independent judgments, and evaluate risks. This continuous process of learning and critical analysis empowers you to make rational decisions, avoid common pitfalls, and stay focused on your long-term goals, regardless of short-term market noise. By cultivating the discipline to read deeply and think critically, you are equipping yourself with the most powerful tools available to any investor. Invest in your mind, and your portfolio will thank you. Happy reading and thinking!