Can FedEx Beat UPS in 2024? Delivery Market Outlook

Delivery Volume Shift: FedEx and UPS vs. Amazon & Regional Carriers

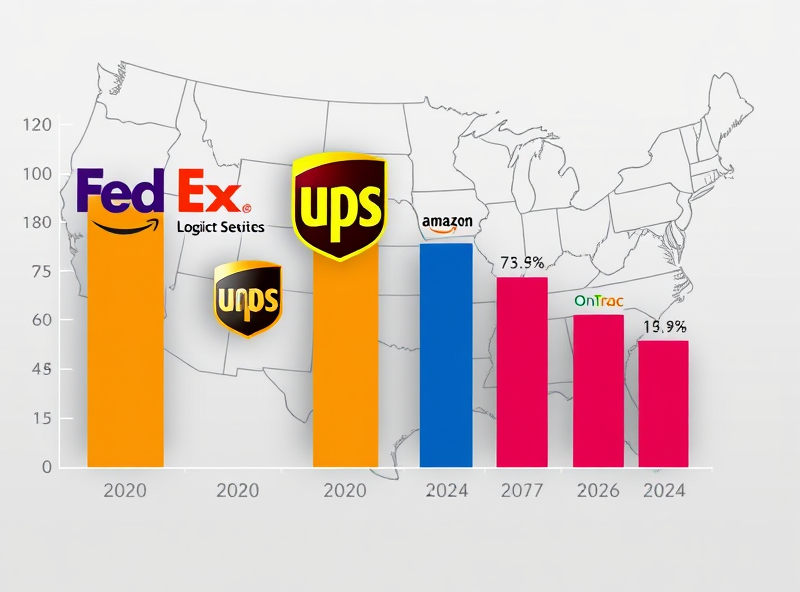

In recent years, the U.S. parcel delivery market has seen a significant shift in volume distribution. Traditionally dominated by FedEx and UPS, the landscape is now being reshaped by Amazon’s rapidly expanding logistics network and the growing presence of regional carriers. This shift is not just a temporary trend—it reflects a structural change in how goods are moved, especially in the e-commerce era.

Amazon, once a major client of both FedEx and UPS, has been steadily building its own delivery infrastructure. In 2023, Amazon Logistics reportedly delivered over 5.9 billion packages in the U.S., surpassing both FedEx and UPS in residential deliveries. This in-house delivery model allows Amazon to control costs, improve delivery speed, and offer more flexible options to customers.

Meanwhile, regional carriers such as LaserShip, OnTrac, and LSO are gaining traction, especially among small to mid-sized e-commerce businesses. These carriers offer competitive pricing, faster last-mile delivery in specific zones, and greater flexibility during peak seasons. Their rise is particularly impactful in urban and suburban areas where delivery density supports efficient routing.

For FedEx and UPS, this volume shift poses both a challenge and an opportunity. They are investing heavily in automation, route optimization, and sustainability initiatives to stay competitive. FedEx, for example, is focusing on its Ground Economy service and enhancing its e-commerce fulfillment capabilities. UPS is targeting high-margin sectors like healthcare logistics and small business shipping.

For consumers and businesses, this evolving landscape means more choices, better pricing, and faster delivery—especially if they are willing to work with a mix of national and regional providers. It also highlights the importance of flexibility and innovation in logistics.

For a deeper dive into Amazon’s logistics growth, you can refer to this analysis by the Wall Street Journal: https://www.wsj.com/articles/amazon-delivery-network-growth-fedex-ups-11672066280

Speed, Reach, and Specialization: Comparing Core Services

In the ever-evolving logistics landscape, choosing between FedEx and UPS in 2024 comes down to three essential factors: speed, network reach, and service specialization. Each carrier has its strengths, and understanding these can help businesses and individuals make smarter shipping decisions.

When it comes to speed, FedEx often takes the lead in express deliveries. FedEx Express offers overnight and same-day options that are highly reliable, especially for time-sensitive shipments. UPS, however, has been catching up with competitive express services and enhanced last-mile delivery options through its growing partnership with the USPS and other third-party providers.

In terms of reach, UPS has a slight edge in global coverage. With operations in over 220 countries and territories, UPS has invested heavily in international infrastructure, including customs clearance and freight forwarding. FedEx, while also global, focuses more on North American markets, making it ideal for domestic shipments within the U.S. and Canada.

Specialization is where the two companies diverge significantly. FedEx is known for its strength in B2B logistics, particularly in sectors like healthcare, aerospace, and e-commerce fulfillment. Their FedEx Custom Critical and FedEx Supply Chain services are tailored for high-value, temperature-sensitive, or time-definite shipments. UPS, on the other hand, has leaned into small business solutions, offering tools like UPS My Choice and a strong network of UPS Stores to support local entrepreneurs.

For those shipping frequently or managing supply chains, the best choice depends on your priorities: FedEx for speed and specialized logistics, UPS for broader reach and small business support. Keeping an eye on both companies’ strategic investments in automation and sustainability will also be key in 2024.

For a deeper look at each carrier’s performance and strategy, you can refer to the official reports from the U.S. Department of Transportation: https://www.transportation.gov/.

FedEx’s Growth Strategy: Discounts, Speed, and SMB Focus

In 2024, FedEx is doubling down on a strategic growth plan that focuses on three key pillars: competitive pricing, faster delivery speeds, and stronger support for small and medium-sized businesses (SMBs). These initiatives are not only helping FedEx stay competitive with UPS but also adapt to a rapidly evolving logistics landscape shaped by e-commerce and customer expectations.

First, FedEx is offering more aggressive discounts to attract volume, especially from SMBs. By simplifying rate structures and providing more transparent pricing, FedEx is making its services more accessible to smaller businesses that often struggle with high shipping costs. This move is particularly important as SMBs account for a growing share of e-commerce transactions.

Second, speed remains a top priority. FedEx has invested heavily in its Ground network and automation technologies to reduce delivery times. With enhanced routing algorithms and expanded weekend delivery, the company is now able to compete more effectively with Amazon and UPS on speed, which is a critical factor for online retailers and their customers.

Lastly, FedEx is strengthening its relationships with SMBs through tailored logistics solutions, dedicated account support, and digital tools that help businesses manage shipping more efficiently. The company’s FedEx Ship Manager and integration with e-commerce platforms like Shopify are examples of how it’s making shipping easier and more scalable for growing businesses.

These strategies reflect a broader shift in the delivery market, where personalization, flexibility, and digital transformation are becoming key differentiators. As FedEx continues to evolve, its focus on value-driven services and operational efficiency could help it close the gap with UPS and meet the changing needs of modern commerce.

For more on FedEx’s strategic direction, you can visit their official investor relations page: https://investors.fedex.com

Delivery Volume Shift: FedEx and UPS vs. Amazon & Regional Carriers

The logistics landscape is evolving rapidly, and in 2024, FedEx and UPS face growing competition not just from each other, but from powerful e-commerce giants like Amazon and nimble regional carriers. While FedEx and UPS have long dominated the parcel delivery market, their traditional models are being challenged by new players that are reshaping last-mile delivery.

Amazon, for instance, has aggressively expanded its in-house logistics network, now handling the majority of its own deliveries. According to Pitney Bowes’ Parcel Shipping Index, Amazon Logistics delivered over 5 billion packages in the U.S. in 2022, and that number is expected to grow. This shift reduces dependency on FedEx and UPS, directly impacting their delivery volumes and revenue streams.

Meanwhile, regional carriers and gig-economy-based services like DoorDash and Instacart are increasingly being used for same-day and hyperlocal deliveries. These services offer flexibility, lower costs, and faster delivery times in urban areas, making them attractive to both consumers and retailers.

For FedEx and UPS to stay competitive, they must invest in technology, automation, and customer-centric delivery options. Enhancing route optimization, expanding weekend deliveries, and partnering with local businesses for pickup/drop-off points are some of the strategies they’re exploring.

In short, while FedEx and UPS remain key players, the delivery market is fragmenting. Consumers and businesses alike benefit from this competition through faster, cheaper, and more flexible delivery options.

For more insights, you can refer to the Pitney Bowes Parcel Shipping Index: https://www.pitneybowes.com/us/shipping-index.html