Federal vs State Grants: Key Differences Explained

Understanding the Purpose of Federal and State Grants

Grants are powerful tools used by both the federal and state governments to support public programs, research, education, and community development. Understanding their purpose can help individuals, nonprofits, and local governments better access funding that can transform lives and communities.

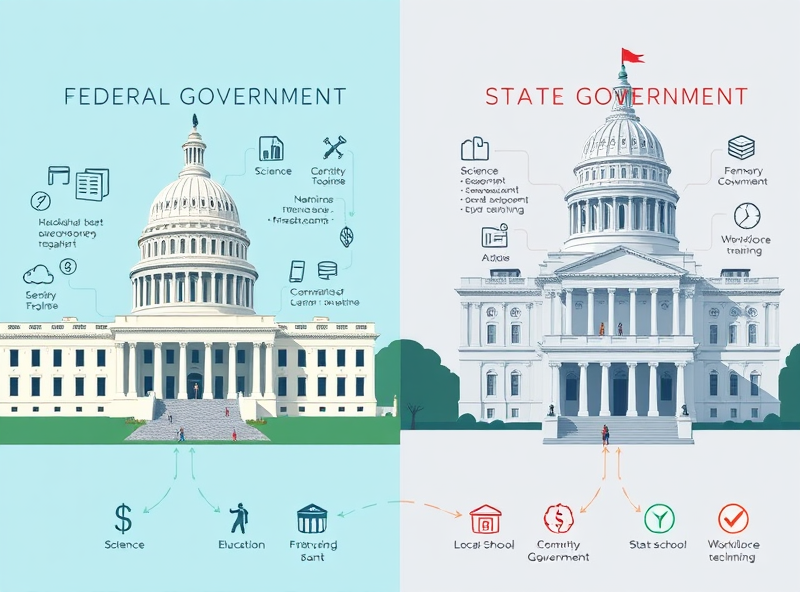

Federal grants are typically designed to address national priorities. These include areas like scientific research, infrastructure, education, and public health. Because they are funded by the federal government, they often come with strict guidelines and oversight to ensure the money is used as intended. For example, a federal grant might fund a nationwide initiative to improve broadband access in rural areas.

On the other hand, state grants are more localized. They aim to address the specific needs of the state’s residents. These could include support for local schools, environmental conservation projects, or workforce development programs. State grants tend to be more flexible and may have fewer bureaucratic hurdles compared to federal grants.

The key takeaway is that federal grants often support broad, large-scale initiatives, while state grants focus on regional or community-level improvements. Knowing the difference can help you apply for the right type of funding based on your goals.

For more detailed information on federal grants, you can visit the official U.S. government grant portal: https://www.grants.gov/

How Funding Sources Differ Between Federal and State Programs

When exploring grant opportunities, it’s important to understand that federal and state programs differ significantly in how they are funded and administered. This distinction can influence eligibility, application processes, and even the types of projects that receive support.

Federal grants are funded directly by the U.S. government through agencies like the Department of Education, the National Institutes of Health (NIH), or the Department of Housing and Urban Development (HUD). These grants are typically supported by federal tax revenues and are often distributed nationwide. They tend to focus on large-scale issues such as scientific research, infrastructure, education, and public health. Because of their broad scope, federal grants often come with stringent compliance and reporting requirements.

On the other hand, state grants are funded by state governments, usually through a combination of state tax revenues and federal pass-through funds. These grants are more localized and are designed to address region-specific needs such as community development, local education initiatives, or workforce training. State grants may offer more flexibility in how funds are used, and their application processes can be less competitive than federal ones.

Understanding the origin of the funding helps applicants align their projects with the right opportunities. For example, a nonprofit seeking to address homelessness in a specific city might find more targeted support through a state or municipal grant, while a university conducting nationwide research on climate change might be better suited for a federal grant.

To explore federal grant opportunities, you can visit the official Grants.gov website: https://www.grants.gov/

Grant Flexibility and Target Audiences Across Government Levels

When exploring funding opportunities, it’s essential to understand how federal and state grants differ in terms of flexibility and target audiences. These differences can significantly impact your eligibility and how you can use the funds.

Federal grants are typically more rigid in their structure. They often come with strict guidelines, detailed reporting requirements, and narrowly defined objectives. These grants are usually designed to address national priorities such as scientific research, infrastructure, or education reform. Because of their scale and scope, federal grants often target large institutions, such as universities, state governments, or major nonprofits.

On the other hand, state grants tend to offer more flexibility. While they still have requirements, they are often more adaptable to local needs and may allow for broader interpretations of how funds can be used. State grants are commonly aimed at smaller organizations, local governments, or community-based initiatives. This makes them an excellent option for grassroots projects or region-specific programs.

Understanding this distinction can help you choose the right grant for your project. If your initiative aligns with a national agenda and you have the capacity to manage complex compliance, a federal grant might be ideal. But if you’re addressing a local issue and need more adaptable funding, a state grant could be a better fit.

For a comprehensive overview of federal grants, you can visit the official government portal: https://www.grants.gov/

Accountability and Execution in Government Grant Distributions

When it comes to government grants, understanding how accountability and execution differ between federal and state levels is essential for organizations, nonprofits, and even individuals applying for funding. These differences can significantly impact how funds are managed, reported, and utilized.

Federal grants are typically governed by strict, standardized guidelines. Agencies like the U.S. Department of Health and Human Services or the Department of Education enforce uniform compliance rules through the Office of Management and Budget (OMB) circulars, such as the Uniform Guidance (2 CFR Part 200). These rules ensure transparency, performance measurement, and financial integrity. Grantees must submit regular reports, undergo audits, and meet clearly defined objectives. This level of oversight ensures that taxpayer money is used efficiently and for its intended purpose.

On the other hand, state grants often allow for more flexibility in execution, adapting to local needs and priorities. While states still follow federal guidelines when distributing pass-through federal funds, they may also have their own reporting systems and performance metrics. This can sometimes lead to variations in accountability standards, which is why it’s crucial for applicants to thoroughly understand the specific requirements of each grant program.

For example, a nonprofit receiving a federal grant for community health initiatives may need to provide quarterly progress reports, maintain detailed financial records, and participate in site visits. A similar state grant might have more lenient reporting timelines or allow for broader interpretation of program goals, depending on the state’s administrative capacity and policy focus.

In both cases, successful grant execution depends on strong internal controls, transparent communication, and a clear understanding of the funding agency’s expectations. Applicants should always review the Notice of Funding Opportunity (NOFO) and reach out to grant officers with any questions.

For more detailed guidance on federal grant compliance, you can refer to the official Uniform Guidance by the U.S. Government: https://www.ecfr.gov/current/title-2/subtitle-A/chapter-II/part-200

Understanding these differences not only helps in maintaining compliance but also increases the chances of successful project implementation and future funding opportunities.