Geopolitical Risk: The Hidden Driver Behind Your US Stock Market Strategy

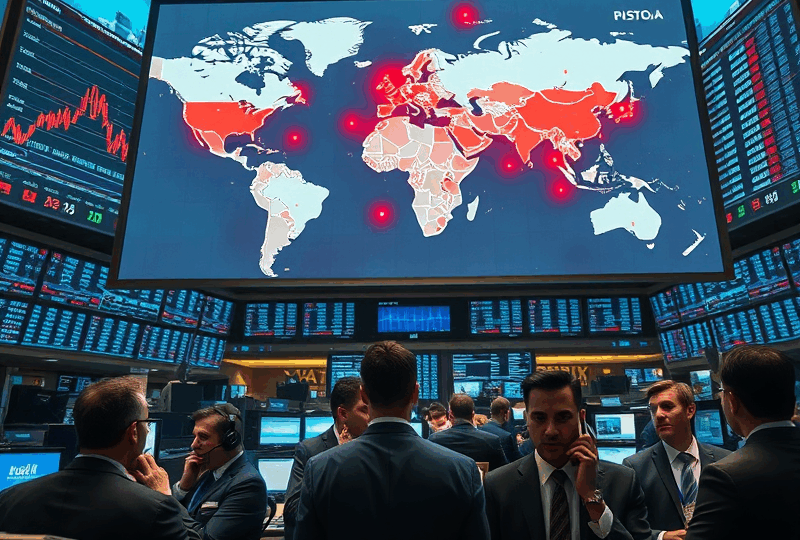

When most American investors think about the stock market, they often focus on interest rates, earnings reports, or Federal Reserve decisions. But there’s another powerful, often overlooked force that can significantly influence your portfolio: geopolitical risk.

In today’s interconnected world, political instability, international conflicts, and diplomatic tensions can send shockwaves through the financial markets. Whether it’s a sudden military escalation in Eastern Europe, trade tensions with China, or political unrest in the Middle East, these events can create volatility and alter the trajectory of U.S. stocks. Understanding how these risks work—and how to factor them into your investment strategy—is essential for long-term success.

What Is Geopolitical Risk?

Geopolitical risk refers to the potential for political events or instability in one country or region to impact global markets. These risks can stem from wars, terrorism, sanctions, regime changes, or even diplomatic breakdowns. For U.S. investors, such events can affect everything from oil prices to the value of the dollar, to the performance of multinational corporations.

Why Should U.S. Investors Care?

Even if a conflict is happening thousands of miles away, its effects can ripple across the globe. For example:

– The Russia-Ukraine war has caused energy prices to spike, affecting inflation and consumer spending in the U.S.

– Tensions between the U.S. and China over Taiwan have raised concerns about the stability of global supply chains, especially in the tech sector.

– Political instability in oil-producing nations can lead to market uncertainty and higher gas prices at home.

Understanding these dynamics helps investors anticipate market movements and adjust their portfolios accordingly.

How Geopolitical Risk Impacts Different Sectors

Not all sectors are affected equally by geopolitical events. Here’s a breakdown:

– Energy: Oil and gas stocks often surge during geopolitical tensions, especially if supply disruptions are expected.

– Defense: Companies in the defense sector may benefit from increased government spending during periods of military conflict.

– Technology: Highly sensitive to global supply chains and trade relations, tech stocks can be volatile during international disputes.

– Consumer Goods: These companies may face increased costs or reduced demand due to inflation or economic uncertainty.

Using Geopolitical Risk in Your Investment Strategy

Here are a few ways to incorporate geopolitical awareness into your investment approach:

1. Diversify Globally: While the U.S. market is robust, consider exposure to other regions to hedge against localized risk.

2. Monitor News and Policy: Stay informed about international developments and how they might affect specific sectors.

3. Consider Safe Havens: Assets like gold, U.S. Treasury bonds, and defensive stocks can offer stability during turbulent times.

4. Use ETFs Strategically: Sector-specific ETFs can help you gain exposure to industries that may benefit from geopolitical trends.

Recent Examples of Geopolitical Risk in Action

– In 2022, the invasion of Ukraine led to a surge in oil prices and a sell-off in European markets, affecting U.S. energy and defense stocks.

– In 2023, rising tensions in the South China Sea caused volatility in semiconductor stocks due to fears of supply chain disruptions.

– In early 2024, political unrest in Latin America led to currency devaluations, impacting U.S. companies with significant operations in the region.

How to Stay Ahead

Staying ahead of geopolitical risk doesn’t mean trying to predict every global event. Instead, it’s about being prepared. Here are some tips:

– Follow reputable financial news sources like Bloomberg, Reuters, and The Wall Street Journal.

– Subscribe to geopolitical risk assessments from think tanks or financial research firms.

– Work with a financial advisor who understands global markets and can help you build a resilient portfolio.

Conclusion

Geopolitical risk is a hidden but powerful force in the U.S. stock market. By understanding its impact and integrating it into your investment strategy, you can better navigate market volatility and protect your financial future. In an increasingly complex world, being globally aware is not just smart—it’s essential.

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Investing involves risk, including the potential loss of principal. Always consult with a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.