Heal Your Portfolio: Why Healthcare Stocks Could Be Your Next Smart Investment

The demand for healthcare services and products is driven by powerful, long-term trends that are unlikely to reverse. An aging global population means more people require medical care, pharmaceuticals, and medical devices. Advances in technology and research are leading to new treatments and therapies, creating new markets and opportunities. While healthcare can be complex, understanding its basic drivers and components can help you identify compelling investment prospects. It’s a sector that combines defensive characteristics with exciting growth potential fueled by innovation.

The Enduring Strength of Healthcare Demand

One of the most compelling aspects of the healthcare sector is the relatively inelastic demand for its products and services. When people are sick or need medical attention, they generally seek it regardless of the economic climate. This makes healthcare spending less discretionary than spending on things like travel or luxury goods. While elective procedures might decrease during a recession, essential medical needs remain, providing a stable revenue base for many healthcare companies. This inherent demand contributes to the sector’s reputation as a defensive play, offering a degree of stability during market downturns.

Furthermore, demographic shifts, particularly the aging population in the US and globally, are creating a sustained increase in the need for healthcare. As people live longer, they require more medical attention, from managing chronic conditions to undergoing age-related treatments and procedures. This demographic tailwind provides a strong foundation for long-term growth in the sector.

Navigating the Diverse Healthcare Landscape

The healthcare sector is vast and includes a wide array of industries, each with its own dynamics and investment characteristics. Understanding these sub-sectors is crucial for building a diversified healthcare allocation:

- **Pharmaceuticals:** Companies that discover, develop, manufacture, and market drugs. Success in this area depends heavily on research and development (R&D) pipelines and the ability to bring new, effective drugs to market.

- **Biotechnology:** Focuses on using biological processes to develop products, often including cutting-edge therapies and vaccines. This is a high-growth, high-risk area with significant potential for breakthrough discoveries.

- **Medical Devices & Equipment:** Companies that produce instruments, apparatus, and implants used in healthcare. Innovation in this area can lead to improved patient outcomes and new market opportunities.

- **Healthcare Providers & Services:** Includes hospitals, clinics, nursing homes, and managed healthcare organizations (like health insurance companies). Their performance can be influenced by government policies, reimbursement rates, and patient volumes.

- **Healthcare Technology:** Companies developing software, data analytics, and digital tools to improve healthcare delivery, patient management, and research. This is a rapidly growing intersection of tech and healthcare.

Each sub-sector has different drivers and risks, offering various ways to gain exposure to the broader healthcare theme.

Key Growth Drivers: Innovation and Demographics

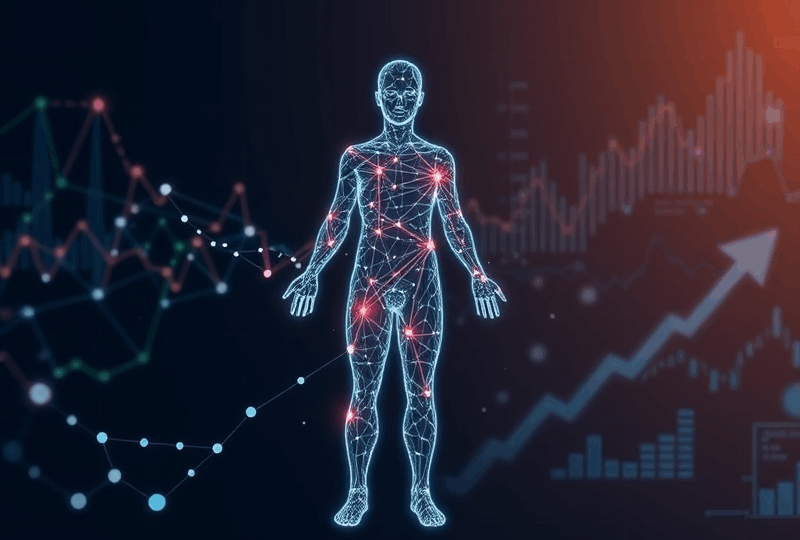

Beyond the stable base demand, the healthcare sector is propelled by powerful growth engines. Technological innovation is constantly pushing the boundaries of what’s possible, from gene editing and personalized medicine to advanced surgical robotics and AI-powered diagnostics. Companies at the forefront of these innovations have the potential for significant growth.

The increasing prevalence of chronic diseases also drives demand for ongoing treatment and management. Furthermore, rising healthcare spending per capita in many developed and developing nations contributes to the sector’s expansion. While healthcare costs are a complex societal issue, they translate into revenue and growth opportunities for healthcare companies.

Analyzing Healthcare Investment Opportunities

When evaluating healthcare stocks, traditional financial analysis is important, but you also need to consider sector-specific factors. For pharmaceutical and biotech companies, the R&D pipeline is critical – what new drugs are in development, and what are their prospects? Understanding the clinical trial process and regulatory approval pathways (like the FDA in the US) is essential.

For medical device companies, innovation cycles and patent protection are key. For healthcare providers, factors like patient volumes, reimbursement rates from government programs (like Medicare and Medicaid) and private insurers, and operational efficiency are crucial. Regulatory risk is a significant factor across the sector, as government policies can impact drug pricing, approval processes, and healthcare delivery models.

Risks and Challenges in the Sector

Despite its defensive qualities and growth drivers, the healthcare sector faces unique risks. Regulatory hurdles are significant; getting a new drug or device approved is a long, expensive, and uncertain process. R&D failure is common in pharmaceuticals and biotech; many promising candidates never make it to market. Pricing pressure, particularly on prescription drugs, is a recurring political and social issue that can impact profitability.

Healthcare providers face risks related to changing regulations, rising costs, and competition. While demand is generally stable, shifts in insurance coverage or government policies can affect revenue. Understanding these sector-specific risks is vital for informed investment decisions.

Investing Approaches: Stocks, ETFs, and Mutual Funds

You can invest in the healthcare sector by buying individual stocks of companies you’ve researched. This allows for targeted exposure but concentrates risk. Alternatively, healthcare-focused ETFs and mutual funds offer diversified exposure to a basket of healthcare companies or specific sub-sectors. These funds can track broad healthcare indices (like the S&P 500 Healthcare sector) or focus on areas like biotech, medical devices, or pharmaceuticals.

ETFs and mutual funds are often a convenient way to gain exposure to the sector without having to pick individual winners and losers. They provide instant diversification and professional management. Consider your investment goals and risk tolerance when deciding between individual stocks and funds.

The Long-Term Outlook for Healthcare Investing

The long-term outlook for the healthcare sector remains compelling. The fundamental drivers of demand – aging populations, rising global wealth, and continuous innovation – are powerful and enduring. Advances in areas like genomics, artificial intelligence in diagnostics and drug discovery, and telemedicine are poised to reshape healthcare delivery and create new investment opportunities.

While the sector will continue to face challenges, including cost pressures and regulatory scrutiny, its essential nature and capacity for innovation suggest it will remain a vital and potentially rewarding area for investors. Incorporating a healthcare allocation into a diversified portfolio can provide both defensive stability and exposure to long-term growth trends.

Summary: A Healthy Addition to Your Portfolio

In summary, the healthcare sector offers a compelling blend of defensive stability and long-term growth potential, driven by demographic trends and relentless innovation. Its diverse sub-sectors, from pharmaceuticals and biotech to medical devices and healthcare services, provide numerous investment opportunities. While navigating regulatory risks and R&D challenges is crucial, the essential nature of healthcare demand makes it a resilient sector. By conducting thorough research, understanding the different industries within healthcare, and considering diversified investment approaches like ETFs, you can potentially make a healthy addition to your investment portfolio. Invest in health, invest in the future!