Intel Stock Analysis: Can This Semiconductor Giant Make an Epic Comeback in the AI Era?

Intel’s Place in the Semiconductor World

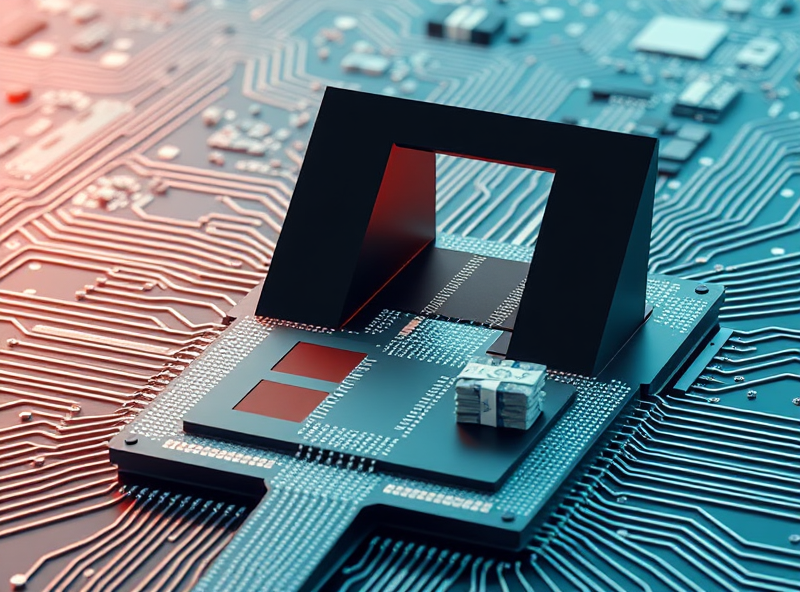

Intel designs and manufactures microprocessors and other semiconductor products. Historically, its core business has been supplying chips for personal computers (PCs) and data centers. These are critical components that power everything from your laptop to the massive servers that run the internet and cloud computing services. Intel has also expanded into areas like graphics processing units (GPUs), automotive chips, and networking.

The semiconductor industry is incredibly complex and capital-intensive, requiring massive investments in research and development (R&D) and manufacturing facilities (fabs). Intel has traditionally been one of the few companies that both designs and manufactures its own chips, a model known as integrated device manufacturing (IDM).

Facing Increased Competition

One of the biggest challenges Intel has faced is increased competition. In the PC market, AMD has gained market share with competitive processor offerings. In the data center market, companies like AMD and Nvidia have become strong competitors, particularly with the rise of specialized chips for artificial intelligence (AI) and high-performance computing.

Furthermore, many technology companies are now designing their own custom chips (like Apple’s M-series chips), sometimes relying on third-party manufacturers like TSMC. This trend of “in-housing” chip design by major customers poses another challenge to Intel’s traditional business model.

Manufacturing Challenges and Strategy

Intel has also faced challenges in its manufacturing process, experiencing delays in developing and implementing next-generation chip fabrication technologies. This has allowed competitors like TSMC to take a lead in producing smaller, more efficient chips, which is critical in the semiconductor race.

In response, Intel has launched an ambitious strategy called “IDM 2.0.” This strategy involves revitalizing its internal manufacturing capabilities, utilizing third-party foundries for some of its chip production, and, importantly, establishing Intel Foundry Services (IFS) to manufacture chips for other companies. This move aims to turn Intel’s manufacturing expertise into a service for the broader industry.

Financial Performance and Outlook

Intel’s financial performance has been impacted by the competitive pressures and manufacturing challenges. Revenue growth has been inconsistent, and profitability has faced headwinds due to increased R&D and capital expenditures required for its turnaround strategy. Investors are closely watching for signs that the IDM 2.0 strategy is yielding results.

Key metrics to watch include revenue from its core segments (Client Computing Group and Data Center and AI), gross margin (which reflects manufacturing efficiency and pricing power), and capital expenditures (capex) related to building new fabs. The outlook for Intel is heavily dependent on its ability to execute its manufacturing roadmap and regain market share.

Growth Opportunities

Despite the challenges, Intel has significant growth opportunities. The demand for semiconductors is expected to grow significantly in the coming years, driven by trends like AI, 5G, the Internet of Things (IoT), and the increasing digitalization of the economy. Intel is targeting these growth areas with new product offerings and its foundry services.

The potential success of Intel Foundry Services is a major opportunity. If Intel can become a significant provider of chip manufacturing services to other companies, it could open up a large new revenue stream and leverage its manufacturing assets more effectively. Government initiatives in various countries to boost domestic semiconductor manufacturing could also benefit Intel.

Valuation and Investment Considerations

When evaluating Intel stock, investors often look at the price-to-earnings (P/E) ratio and compare it to other semiconductor companies. However, given the company’s turnaround efforts and significant investments, traditional valuation metrics might need to be considered alongside the potential for future growth and execution of its strategy.

Considering Intel as an investment involves assessing the likelihood of its comeback strategy succeeding. Can they regain their manufacturing lead? Can they effectively compete in new markets like AI and GPUs? Is the foundry business likely to be successful? It’s an investment that requires a belief in the company’s ability to execute a complex transformation.

Summary and Final Thoughts

Intel is a historic leader in the semiconductor industry that is currently undergoing a significant transformation to address competitive pressures and manufacturing challenges. The company is investing heavily in its IDM 2.0 strategy, aiming to revitalize its manufacturing and become a major foundry player.

For investors who believe in Intel’s long-term vision, its ability to execute its ambitious turnaround plan, and the continued growth of the semiconductor market, the stock could potentially offer significant upside if the comeback is successful. However, this is not without risk, as the execution of such a large-scale transformation is challenging. As always, conducting your own thorough research and considering your personal financial situation and goals are essential before making any investment decisions.