Public Storage (PSA) REIT Analysis: Boom or Caution?

Market Resilience in Self-Storage Industry

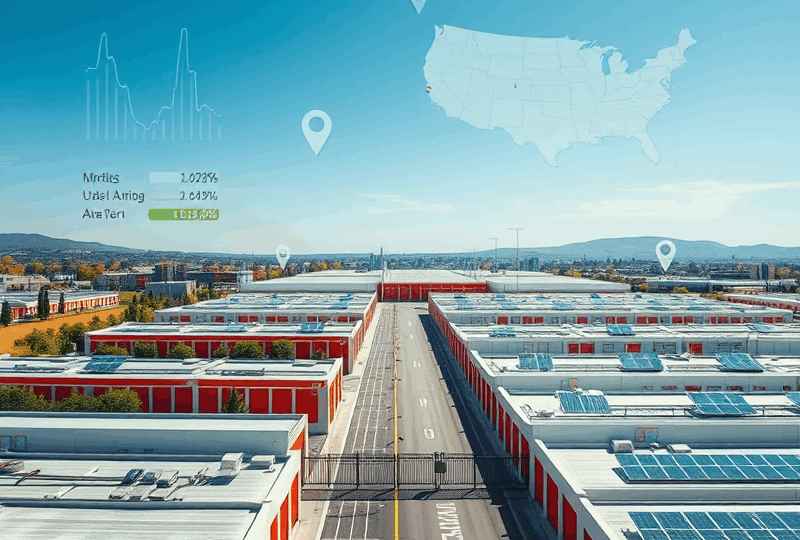

The self-storage industry has demonstrated remarkable resilience over the past decade, and Public Storage (PSA), one of the largest REITs in this sector, continues to be a key player. This resilience is not just anecdotal—it’s backed by strong financials, stable occupancy rates, and increasing consumer demand, even during economic downturns.

One of the main reasons for this market strength is the consistent demand for storage space. Whether due to life transitions like moving, downsizing, or remote work trends, individuals and businesses alike require flexible storage solutions. PSA has capitalized on this trend by maintaining a diversified portfolio across major U.S. markets, which helps mitigate regional economic risks.

Additionally, the self-storage sector tends to be less sensitive to economic cycles compared to other real estate sectors. During recessions, people downsize and need storage; during economic booms, businesses expand and require additional space. This dual-demand dynamic creates a buffer against market volatility.

Public Storage has also embraced technology to improve operational efficiency and customer experience. From contactless rentals to AI-driven pricing models, PSA is staying ahead of the curve, which is crucial in maintaining its competitive edge.

For investors, this means that PSA can offer relatively stable returns and act as a defensive asset in a diversified portfolio. However, it’s still important to monitor interest rate trends and regional supply saturation, which could impact future performance.

For more detailed financial insights, you can refer to PSA’s latest investor presentation here: https://investors.publicstorage.com

In summary, the self-storage industry—and PSA in particular—has shown strong market resilience, making it a potentially valuable component in long-term investment strategies.

Financial Health and Dividend Strategy

Public Storage (PSA), one of the largest self-storage REITs in the U.S., has long been considered a stable and reliable investment. But how does its financial health and dividend strategy hold up in today’s market environment? Let’s take a closer look to help you make informed decisions.

PSA’s financial foundation is notably strong. As of its latest quarterly report, the company maintains a low debt-to-equity ratio and a healthy interest coverage ratio, which indicates it can comfortably meet its debt obligations. This financial prudence is a key reason why PSA has maintained its A-rated credit status by agencies like S&P Global Ratings. Such ratings are rare in the REIT sector and reflect PSA’s conservative capital management and strong cash flow generation.

In terms of dividend strategy, PSA is known for its consistent and generous payouts. The company follows a dividend policy that aligns closely with its funds from operations (FFO), a key metric for REITs. In 2023, PSA paid out over 75% of its FFO as dividends, maintaining both compliance with REIT distribution requirements and investor satisfaction. Historically, PSA has increased its dividend over time, reflecting growth in earnings and a commitment to shareholder returns.

One important aspect to note is PSA’s strategic use of retained earnings to fund expansion and acquisitions, rather than relying heavily on debt. This approach not only supports long-term growth but also reduces financial risk, especially in a rising interest rate environment.

For investors seeking income and stability, PSA’s strong balance sheet and disciplined dividend policy make it a compelling choice. However, like all investments, it’s essential to consider market conditions and personal financial goals before making a decision.

For more detailed financial data, you can visit PSA’s official investor relations page: https://www.publicstorage.com/investors

Stock Performance and Analyst Forecasts

Public Storage (PSA), one of the largest self-storage REITs in the U.S., has shown a mixed stock performance over the past year. While the broader REIT sector faced headwinds due to rising interest rates and economic uncertainty, PSA has demonstrated relative resilience, thanks to its strong balance sheet and consistent demand for self-storage solutions.

As of early 2024, PSA’s stock has slightly underperformed the S&P 500 but remains a stable income-generating asset for long-term investors. The company maintains a solid dividend yield, currently around 4%, which continues to attract income-focused investors. Analysts generally hold a ‘Hold’ to ‘Moderate Buy’ consensus on PSA, with price targets ranging between $280 and $320, depending on macroeconomic conditions and occupancy trends.

One of the key factors supporting PSA’s valuation is its ability to maintain high occupancy rates and increase rental rates even during economic slowdowns. The self-storage industry tends to be counter-cyclical, as people downsize or relocate during uncertain times, increasing demand for storage units.

However, analysts also caution about potential risks. These include oversupply in certain markets, increasing competition from smaller operators, and sensitivity to interest rate hikes that could impact REIT valuations overall. Investors should monitor the Federal Reserve’s monetary policy closely, as it will influence PSA’s borrowing costs and overall market sentiment.

For a detailed look at PSA’s financials and analyst ratings, you can visit Morningstar’s official page: https://www.morningstar.com/stocks/xnys/psa/quote

Growth Drivers and Potential Investment Risks

Public Storage (PSA), one of the largest self-storage REITs in the U.S., has demonstrated remarkable resilience and growth over the past decade. As urbanization increases and housing trends shift toward smaller living spaces, the demand for self-storage continues to rise. This demand is further fueled by lifestyle changes such as remote work, relocation, and downsizing, making PSA well-positioned to benefit from long-term structural trends.

One of PSA’s key growth drivers is its scale and operational efficiency. With over 2,800 facilities across the U.S., PSA benefits from economies of scale, strong brand recognition, and data-driven pricing strategies. The company also invests heavily in technology to streamline operations and enhance customer experience, including contactless rentals and dynamic pricing models.

Additionally, PSA has a strong balance sheet with low leverage compared to peers, allowing it to pursue strategic acquisitions and development projects. The company’s REIT structure also offers tax advantages and consistent dividend payouts, making it attractive to income-focused investors.

However, potential investors should be aware of several risks. Rising interest rates could increase PSA’s borrowing costs and pressure property valuations. Furthermore, increased competition from new entrants and other REITs could impact occupancy rates and pricing power. Regulatory changes in zoning or property taxes could also affect profitability.

In summary, while PSA presents compelling growth opportunities driven by demographic and lifestyle trends, investors should remain cautious of macroeconomic headwinds and industry competition. As always, conducting thorough due diligence and aligning investments with your risk tolerance is essential.

For a detailed financial overview, you can refer to PSA’s official investor relations page: https://www.publicstorage.com/investor-relations