Safran Stock Analysis: Investment Opportunities in Aerospace Engine and Defense Sectors

Understanding Safran’s Strategic Position in the Aerospace and Defense Industry

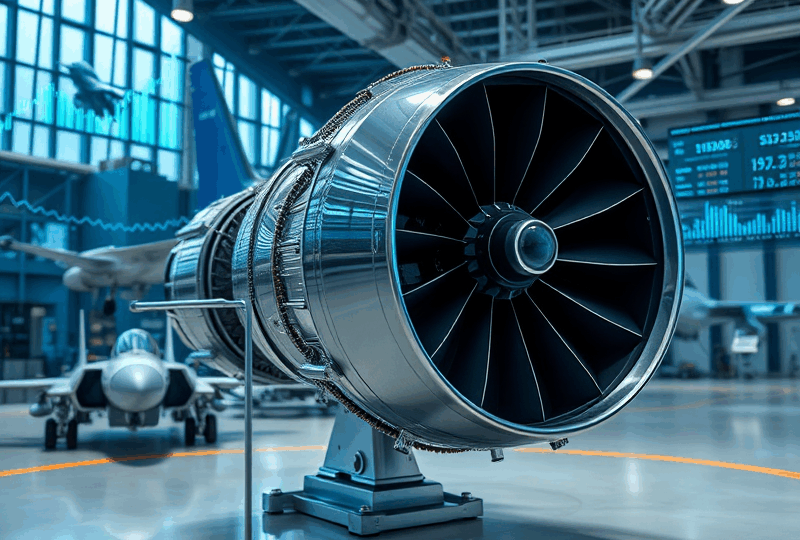

Safran S.A., a French multinational company, has emerged as a critical player in the global aerospace and defense markets. While headquartered in Paris, its influence extends across the Atlantic, particularly through its joint ventures and supply chains that support major U.S. aerospace firms such as Boeing and Lockheed Martin. Safran specializes in aircraft engines, avionics, and defense electronics, making it a strategic asset in both commercial and military aviation sectors.

In the post-2025 global defense environment, Safran has benefited from increased NATO defense spending and the modernization of air fleets. According to the NATO 2024 Defense Expenditure Report, member nations have significantly ramped up their defense budgets, with France committing over 2% of its GDP. This trend directly benefits companies like Safran, which supply propulsion systems and electronic warfare components.

Safran’s LEAP engine, developed in partnership with GE Aviation through CFM International, powers next-generation aircraft like the Boeing 737 MAX and Airbus A320neo. As of Q1 2024, over 5,000 LEAP engines are in service globally, and the backlog continues to grow. The company’s dual exposure to both commercial and military aviation makes it resilient to sector-specific downturns.

Financial Performance and Valuation Metrics

Safran’s financials have shown consistent improvement post-pandemic. In its FY2023 earnings report, the company posted revenues of €23.2 billion, a 19% increase year-over-year. Operating margin improved to 12.4%, driven by robust demand for spare parts and services in the commercial aviation segment. U.S. investors should note that Safran trades on the Euronext Paris under the ticker SAF, but it is also accessible via American Depositary Receipts (ADRs).

Compared to U.S. peers like Raytheon Technologies and General Electric, Safran maintains a higher return on invested capital (ROIC) at 9.8% as of Q1 2024, according to Morningstar. Its price-to-earnings (P/E) ratio stands at 24.7, which is slightly above the industry average but justified by its high-margin aftermarket services and technological edge in propulsion systems.

Here’s a quick comparison table:

| Company | P/E Ratio | ROIC | Dividend Yield |

|---|---|---|---|

| Safran | 24.7 | 9.8% | 1.2% |

| Raytheon Technologies | 20.3 | 7.1% | 2.3% |

| General Electric | 28.5 | 8.4% | 0.4% |

Real-World Applications and U.S. Exposure

Safran’s technology is embedded in several U.S. defense programs. For instance, the company supplies landing gear and wiring systems for the F-35 fighter jet, a cornerstone of U.S. air superiority. In commercial aviation, Safran’s nacelles and engine components are used in Boeing aircraft, reinforcing its exposure to the U.S. market. In 2023, Safran opened a new facility in Texas to support its growing U.S. operations, reflecting its long-term commitment to American aerospace infrastructure.

In an interview with Aerospace America in March 2024, Dr. Elaine Simmons, an aerospace analyst at MITRE Corporation, noted: “Safran’s vertically integrated model and transatlantic partnerships give it a unique advantage in supply chain resilience, especially in a post-COVID world where logistical agility is paramount.”

Risks and Strategic Considerations for U.S. Investors

Despite its strengths, Safran is not without risks. Currency fluctuations between the euro and U.S. dollar can impact returns for American investors. Additionally, geopolitical tensions—particularly in Eastern Europe and the Indo-Pacific—could disrupt supply chains or delay defense contracts. Regulatory differences between the EU and U.S. may also pose compliance challenges.

However, the company’s diversification across civil and military sectors provides a hedge against cyclical downturns. Its increasing investment in sustainable aviation fuel (SAF) and electric propulsion technologies positions it well for the future of green aviation. In 2024, Safran committed €200 million to R&D in decarbonization, according to its official sustainability report.

Conclusion: Is Safran a Buy for U.S. Investors?

For U.S. investors seeking exposure to global aerospace innovation with a strong defense backbone, Safran presents a compelling opportunity. Its partnerships with American firms, robust financials, and strategic investments in future technologies make it a well-rounded addition to a diversified portfolio. While ADR liquidity may be lower than domestic stocks, the long-term growth potential and dividend stability offer attractive compensation.

As always, investors should consult with a financial advisor to assess how international equities like Safran fit into their overall investment strategy, especially considering currency and geopolitical risks.

Disclaimer

This article is for informational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

Author: James M. Reynolds, CFA – Aerospace and Defense Equity Analyst, based in Seattle, WA.