Trump’s New Subsidy Policies: What Changes Are Coming?

Possible Repeal of EV Tax Credits under Section 30D

As part of the evolving landscape of U.S. energy and transportation policy, former President Donald Trump has signaled potential changes to electric vehicle (EV) subsidies, particularly the federal EV tax credit under Section 30D of the Internal Revenue Code. This credit currently offers up to $7,500 to consumers who purchase qualifying electric vehicles, significantly reducing the upfront cost and encouraging EV adoption.

However, if Trump’s new subsidy policies include a repeal or rollback of Section 30D, it could have wide-reaching implications for both consumers and the EV industry. For buyers, the elimination of this credit would mean higher out-of-pocket costs, potentially slowing down the transition to cleaner transportation. For automakers, especially those heavily invested in EV development, this could disrupt sales forecasts and strategic planning.

It’s important to note that Section 30D has been a key driver in the growth of the EV market in the U.S., helping brands like Tesla, Ford, and GM increase adoption. Removing this incentive could also affect U.S. competitiveness in the global EV market, where countries like China and members of the EU continue to support EV adoption through aggressive subsidies.

If you’re considering purchasing an EV, it may be wise to act sooner rather than later, especially if you want to take advantage of the current tax benefits. Keep an eye on official IRS updates and policy announcements from the Department of Energy for the most accurate and timely information.

For more information on the current EV tax credit program, you can visit the official IRS page here: https://www.irs.gov/credits-deductions/individuals/plug-in-electric-drive-vehicle-credit-section-30d

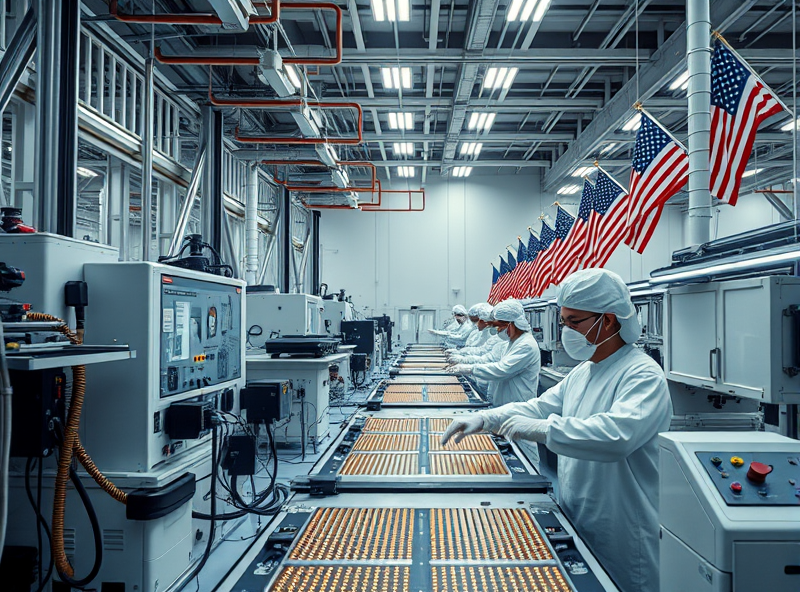

Renegotiation of Semiconductor Subsidy Agreements

As the U.S. semiconductor industry continues to be a strategic priority, former President Donald Trump has signaled a potential shift in how federal subsidies are distributed under the CHIPS and Science Act. The Biden administration initially allocated over $50 billion to boost domestic semiconductor manufacturing, but Trump’s proposed renegotiation of subsidy agreements could reshape the playing field for chipmakers.

Trump’s approach emphasizes stricter terms for foreign-based companies receiving U.S. subsidies. Under his policy outline, companies like TSMC and Samsung, which are building major fabrication plants in Arizona and Texas respectively, may be required to increase technology transfer, commit to long-term U.S. operations, or even face clawback provisions if certain job creation or production targets aren’t met.

This renegotiation could also impact how subsidies are awarded to U.S.-based firms like Intel and Micron. Trump’s policy may prioritize companies that commit to full domestic supply chains, including sourcing raw materials and producing advanced chips entirely within the U.S. While this could strengthen national security and reduce reliance on foreign suppliers, it may also increase costs and slow project timelines.

For industry stakeholders, understanding these potential changes is crucial. Companies should begin reassessing their subsidy agreements and preparing for possible audits or renegotiation clauses. For consumers and workers, this could mean more jobs in the long term, but also possible delays in chip availability or price increases in the short term.

To stay informed on the CHIPS Act and its evolving policies, you can refer to the official U.S. Department of Commerce page: https://www.commerce.gov/chipsact

Federal Budget Shifts Toward Defense Spending

As part of former President Donald Trump’s proposed new subsidy policies, a significant shift in the federal budget is being directed toward defense spending. This change could have wide-reaching implications for both domestic programs and the broader U.S. economy.

The Trump administration’s renewed focus on national security and military readiness is leading to a reallocation of federal funds. In the latest budget proposal, defense spending is expected to increase by over $50 billion, marking one of the largest peacetime hikes in recent history. This funding will primarily support modernization of military equipment, expansion of cyber defense capabilities, and increased personnel benefits.

While this may bolster national security, it also means that other sectors—such as education, environmental protection, and public health—may face budget cuts. For example, the Environmental Protection Agency (EPA) and Department of Education are projected to see reductions in funding, which could impact community programs and services that many Americans rely on.

For individuals and businesses, understanding these shifts is crucial. Contractors in the defense sector may see new opportunities, while those in public services or green energy might need to prepare for reduced federal support. Staying informed about these changes can help you make smarter financial and career decisions.

For more details on the proposed federal budget, you can visit the official Congressional Budget Office (CBO) website: https://www.cbo.gov/publication/58848

Trump’s Policy Focus on Domestic Industry through Tariffs

Former President Donald Trump has consistently emphasized the importance of revitalizing American manufacturing and reducing dependency on foreign imports. One of the key tools he has used to achieve this is the implementation of tariffs — taxes on imported goods — aimed at protecting domestic industries from foreign competition.

Under Trump’s new subsidy policies, there is a renewed focus on using tariffs strategically to support American producers, particularly in sectors like steel, aluminum, and electronics. These tariffs are designed to make imported goods more expensive, thereby encouraging consumers and businesses to buy American-made products. The broader goal is to strengthen domestic supply chains, boost employment in manufacturing, and enhance national economic security.

While tariffs can help protect jobs in certain industries, they may also lead to higher prices for consumers and potential retaliation from trade partners. That’s why it’s important for business owners, especially those in manufacturing or import-heavy sectors, to stay informed about upcoming changes. If you rely on imported components or materials, it might be wise to reassess your supply chain and explore domestic alternatives.

Additionally, small and medium-sized enterprises (SMEs) could benefit from new federal subsidies or tax incentives aimed at reshoring production. These policies may include grants, low-interest loans, or tax breaks for companies that invest in U.S.-based manufacturing.

For those interested in the policy details and potential economic impacts, the U.S. Trade Representative (USTR) provides regular updates on trade measures and tariff schedules: https://ustr.gov

By understanding how these policies affect your industry, you can make more informed decisions that align with both current regulations and long-term business goals.