TSMC Stock Analysis: Why the World’s Top Chipmaker Dominates the Global Tech Supply Chain

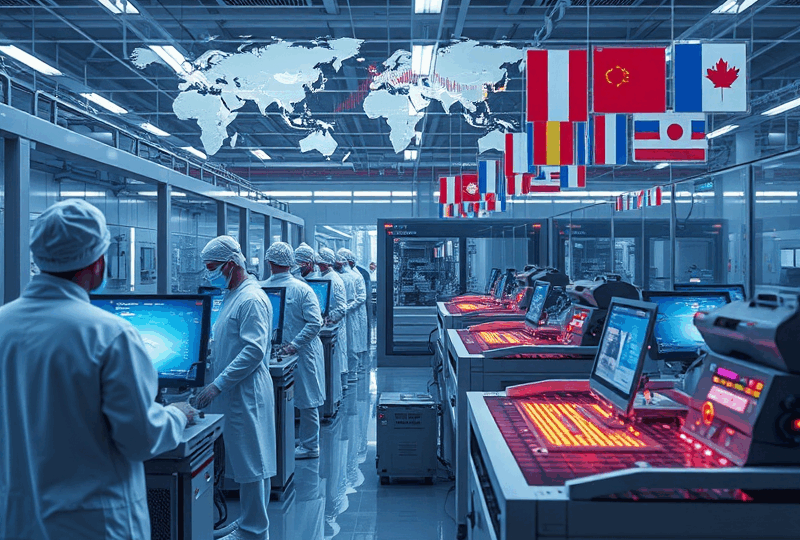

In the ever-evolving world of semiconductors, Taiwan Semiconductor Manufacturing Company (TSMC) has emerged as a linchpin in the global technology ecosystem. As the largest dedicated independent semiconductor foundry in the world, TSMC plays a critical role in the production of chips that power everything from smartphones and laptops to electric vehicles and advanced AI systems. For American investors and tech enthusiasts alike, understanding TSMC’s market position, strategic advantages, and potential risks is essential in evaluating its stock performance and long-term value.

What is TSMC and Why Does It Matter?

Founded in 1987 and headquartered in Hsinchu, Taiwan, TSMC pioneered the foundry model, focusing solely on manufacturing chips designed by other companies. This model allowed fabless companies like Apple, AMD, and NVIDIA to innovate rapidly without the capital burden of building and maintaining their own fabrication plants. Today, TSMC manufactures over 90% of the world’s most advanced semiconductors (5nm and below), making it indispensable to the global tech supply chain.

TSMC’s Role in the U.S. Tech Ecosystem

TSMC’s importance to the U.S. tech industry cannot be overstated. Major American companies such as Apple, Qualcomm, and AMD rely heavily on TSMC for their chip production. In fact, Apple alone accounts for over 25% of TSMC’s revenue. The company’s ability to deliver cutting-edge chips at scale enables U.S. firms to maintain their competitive edge in consumer electronics, data centers, and AI applications.

To mitigate geopolitical risks and strengthen supply chain resilience, TSMC is investing $40 billion in building new fabrication plants in Arizona. These fabs, expected to begin production in 2025, will help localize chip manufacturing and support the Biden administration’s CHIPS and Science Act, which aims to revitalize the domestic semiconductor industry.

Financial Performance and Stock Outlook

TSMC is listed on the New York Stock Exchange under the ticker symbol TSM. As of early 2024, the company boasts a market capitalization exceeding $500 billion, making it one of the most valuable semiconductor firms globally. In 2023, TSMC reported revenues of $69.2 billion and a net income of $26.9 billion, reflecting its strong operational efficiency and robust demand for advanced chips.

Despite macroeconomic headwinds and a cyclical downturn in the semiconductor industry, TSMC has maintained healthy profit margins and continued to invest in R&D and capacity expansion. Analysts project a rebound in chip demand in the second half of 2024, driven by AI, 5G, and automotive applications, which could further boost TSMC’s earnings.

Competitive Advantages: Technology, Scale, and Trust

TSMC’s dominance stems from its technological leadership, massive scale, and trusted partnerships. The company is the first to mass-produce 3nm chips and is actively developing 2nm technology, which promises greater performance and energy efficiency. Its manufacturing scale allows it to offer competitive pricing and absorb the high costs of advanced node development.

Moreover, TSMC has built a reputation for reliability and confidentiality, making it the go-to foundry for companies that need to protect their intellectual property. This trust is especially critical in an era where data security and supply chain integrity are paramount.

Risks to Consider

While TSMC’s future looks promising, investors should be aware of several risks:

1. Geopolitical Tensions: Taiwan’s proximity to China raises concerns about potential conflict, which could disrupt global chip supplies.

2. Supply Chain Disruptions: Natural disasters, pandemics, or equipment shortages could impact production.

3. Rising Competition: Samsung and Intel are investing heavily to catch up in advanced node manufacturing.

4. Currency Fluctuations: As a foreign company, TSMC’s earnings are subject to exchange rate risks for U.S. investors.

Should You Invest in TSMC?

For long-term investors seeking exposure to the semiconductor sector, TSMC offers a compelling mix of innovation, market leadership, and financial strength. Its strategic expansion into the U.S. and continued technological advancements position it well for future growth. However, it’s essential to weigh the geopolitical and industry-specific risks before making an investment decision.

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Investing in stocks involves risk, including the potential loss of principal. Always conduct your own research or consult with a licensed financial advisor before making investment decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.

Conclusion

TSMC is more than just a chipmaker—it’s a foundational pillar of the modern digital economy. Its influence spans continents, powering the innovations that define our daily lives. For American investors, understanding TSMC’s role in the global tech supply chain provides valuable insight into the future of technology and the opportunities that lie ahead in the semiconductor market.