Understanding Government Subsidies and Economic Growth: U.S. Effects Explained

Boosting Consumer Spending with Direct Economic Stimulus

Direct economic stimulus is a powerful tool used by the U.S. government to invigorate consumer spending, especially during times of economic downturn. In simple terms, it involves sending money directly to individuals—often in the form of checks or tax rebates—to encourage immediate spending and support economic activity.

One of the most notable examples of this was the Economic Impact Payments issued during the COVID-19 pandemic. These direct payments helped millions of Americans cover essential expenses, from groceries to rent, and significantly boosted retail sales and consumer confidence. According to the U.S. Bureau of Economic Analysis, personal consumption expenditures surged following each round of stimulus, underlining the effectiveness of this approach.

Why does this matter? Consumer spending accounts for nearly 70% of the U.S. GDP. When people have more disposable income, they tend to spend more on goods and services, which in turn supports businesses, creates jobs, and drives economic growth. This is especially important in times of crisis when economic activity slows down.

Moreover, direct stimulus can help reduce income inequality in the short term by providing immediate relief to lower- and middle-income households who are more likely to spend the money quickly. This targeted approach not only stabilizes the economy but also promotes a faster recovery.

However, it’s important to balance stimulus efforts with long-term fiscal responsibility. While direct payments can be highly effective in the short term, they must be part of a broader economic strategy that includes job creation, infrastructure investment, and sustainable growth policies.

For more insights, you can explore the U.S. Department of the Treasury’s official page on economic impact payments: https://home.treasury.gov/policy-issues/coronavirus/assistance-for-american-families-and-workers/economic-impact-payments

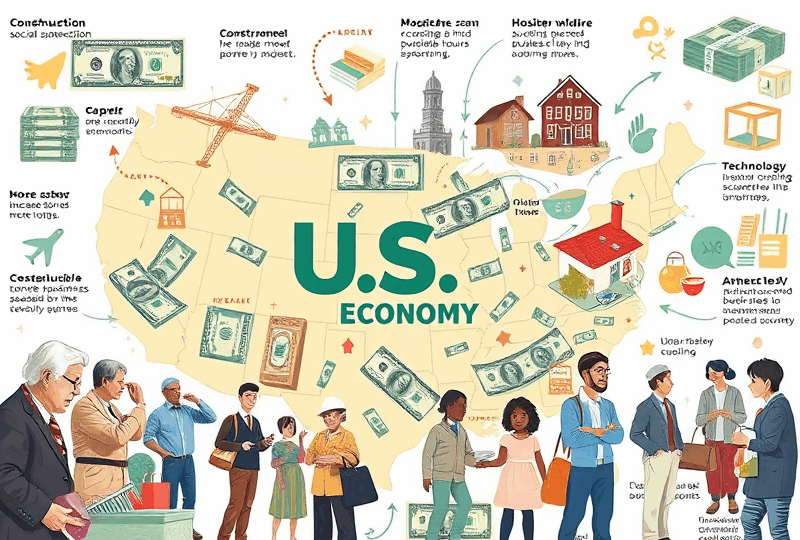

Sector-Specific Impacts: Uneven but Targeted Growth

Government subsidies in the United States are powerful tools used to stimulate economic growth, but their effects are far from uniform across all sectors. Instead, these subsidies are often designed to target specific industries that align with national priorities, such as clean energy, technology innovation, agriculture, and manufacturing. This targeted approach helps drive growth where it’s most needed or where the U.S. aims to gain a competitive edge globally.

For example, the Inflation Reduction Act of 2022 has directed billions of dollars in subsidies toward renewable energy, electric vehicles, and energy-efficient infrastructure. As a result, sectors like solar energy and battery manufacturing have seen a surge in investment and job creation. According to the U.S. Department of Energy, the clean energy sector added over 300,000 jobs in 2022 alone, largely thanks to these government incentives.

Meanwhile, traditional sectors such as fossil fuels or small-scale farming may not receive the same level of support, leading to slower growth or even decline in those areas. This uneven distribution can create regional disparities, especially in communities that rely heavily on industries not prioritized by current subsidy programs.

However, this targeted strategy is not without merit. By focusing on sectors with high growth potential and long-term sustainability, the government aims to future-proof the economy, foster innovation, and support the transition to a greener and more technologically advanced society.

For individuals and businesses, understanding which sectors are being prioritized can offer valuable insights for career planning, investment decisions, and business development. Whether you’re considering a job in clean tech or looking to start a business in a government-supported industry, aligning with these trends can lead to more stable and promising opportunities.

For more information on how federal subsidies are shaping the energy sector, you can visit the U.S. Department of Energy’s official site: https://www.energy.gov/

Limits to Long-Term Productivity Gains

While government subsidies can provide a short-term boost to economic activity, their long-term impact on productivity growth is more nuanced. In the United States, subsidies often target specific industries such as agriculture, renewable energy, and manufacturing, aiming to stimulate innovation and job creation. However, over time, these subsidies can lead to diminishing returns if not carefully managed.

One key limitation is the potential for market distortion. When subsidies are maintained for too long or are not performance-based, they can discourage competition and innovation. Companies may become reliant on government support rather than investing in efficiency or new technologies. This can slow overall productivity growth, especially if resources are allocated to less competitive sectors.

Another challenge is the misalignment between subsidy goals and actual economic outcomes. For example, subsidies intended to promote green energy may not yield proportional productivity gains if the technology adoption curve is slow or if infrastructure lags behind. Additionally, excessive subsidies can strain public budgets, diverting funds from other productivity-enhancing investments like education, infrastructure, or digital transformation.

To ensure long-term productivity gains, it’s essential that subsidies are targeted, time-bound, and linked to measurable outcomes. Policymakers must regularly evaluate the effectiveness of subsidy programs and adjust them based on evolving economic conditions and technological progress.

For a deeper understanding of how subsidies affect economic performance, the Congressional Budget Office provides comprehensive reports: https://www.cbo.gov/

Designing Smart Subsidy Policies for Maximum Impact

Government subsidies, when designed thoughtfully, can be powerful tools to stimulate economic growth, reduce inequality, and support innovation. However, not all subsidies are created equal. Smart subsidy policies focus on long-term impact, efficient allocation of resources, and measurable outcomes.

One key principle is targeting. Instead of broad, untargeted subsidies, governments should prioritize sectors with high growth potential or strategic importance—such as clean energy, advanced manufacturing, or digital infrastructure. For example, the U.S. Inflation Reduction Act of 2022 includes targeted subsidies for renewable energy, aiming to both reduce emissions and create jobs.

Another essential factor is accountability. Subsidies should come with clear performance metrics and sunset clauses. This ensures that public funds are not wasted on programs that fail to deliver results. Transparency also builds public trust—publishing subsidy recipients and outcomes can help monitor effectiveness.

Additionally, smart subsidies often include conditionalities. For instance, companies receiving support may be required to maintain domestic employment levels or invest in R&D. These conditions align private incentives with public goals.

Lastly, collaboration with local governments and private stakeholders can amplify the impact. Federal subsidies can be matched with state-level initiatives or private investment to create multiplier effects.

In summary, designing smart subsidy policies means being strategic, data-driven, and transparent. By doing so, the U.S. can ensure that subsidies not only support short-term recovery but also lay the foundation for sustainable, inclusive growth.

For more on how U.S. federal subsidies are structured, you can visit the Congressional Budget Office: https://www.cbo.gov/topics/budget/subsidies